Casey Files:

This week in 'The Room'

Doug Casey

International Speculator

written Feb 22, 2008

posted Feb 25, 2008

Welcome to "The Room"

The subscribers-only home page of Casey Research.

February 22, 2008

Dear Readers...

Much to talk about this week.

Too much, I fear.

I shall, therefore, endeavor

to be succinct, a trait, unfortunately, that I seemed to have

misplaced in my formative years.

Even so, as I like to believe

that humankind possesses an innate ability to better themselves,

I shall buckle down post haste and give it the old school try.

Hey, How ‘Bout That Gold?

While it’s nice to see

things going along so swimmingly for our favorite form of money,

even I am a little breathless after gold’s surge to yet

another record this week. And its kissing cousin, silver, has

been no slouch either.

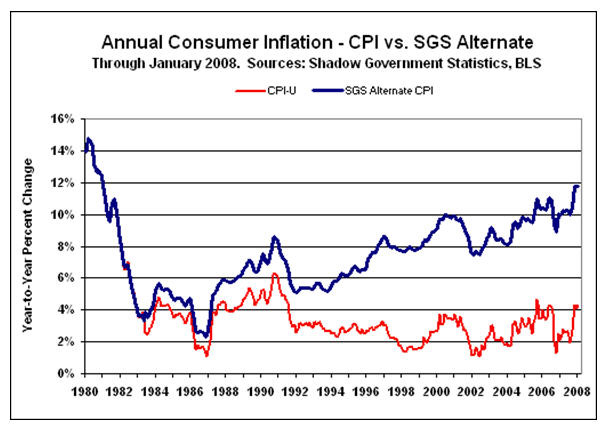

But I am not surprised, given

that the precious metals are doing what they are supposed to

do. Namely, reacting to the rising tide of inflation now beginning

to make itself known here in the U.S. and around the world. This

past week, we learned that even the Comedic Politicized Inflation

index (CPI) is beginning to slip the leash. As you can see in

the chart below from Shadow Government Statistics (shadowstats.com), which

tracks inflation the good old-fashioned way -- i.e., the way

it was done before all the jiggering - the actual rate of inflation

is in a steady upward trend. It is only going to get worse from

here.

On that front, we have been

surveying global inflation and finding that, with only few exceptions,

the trend I brought to your attention last week holds true…

the inflation the U.S. is experiencing is, indeed, worldwide.

That is not to say that there

are no deflationary pressures, there clearly are. Much of which

is related to the declining net worth of homeowners whose inflated

real estate values are headed in the wrong direction.

The result, we believe, will

be akin to one of those television commercials where you have,

say, a truck carrying chocolates colliding with another carrying

peanuts… followed by a smiling bystander, covered in the

accidental mix, licking his lips and finding the formula entirely

to his liking.

Except that the stagflationary

sludge which is coming next – faltering economies concurrent

with higher prices -- will be to almost nobody’s liking.

Unless, of course, you are smart enough to take the necessary

precautions and position yourself to profit. That you are reading

this is highly suggestive that you belong in that category.

Here Comes the Gold Stocks

While there are a number of

reasonable explanations as to why gold stocks have been lagging,

I have come to believe that the single most important reason

has to do with the fact that the price of gold was still under

$280 as recently as January 28, 2002.

Against that number was a cash

cost of around $250 per ounce, which was about as low as it could

go, on the average, indicating an industry doing everything it

could just to survive. Put another way, as a result of the 20-year

bear market up to that point, the industry had been beaten down

about as far as possible. Therefore, as gold began its upward

move, it did so against the backdrop of an industry in mothballs,

running on a skeleton staff and highly optimized operations.

This is important on a number of fronts.

- Having been trained in the

acid bath of razor-thin margins, gold company management teams

were intensely skeptical about gold’s rising price. They

assumed it would be just another bear market trap, ready to punish

unwary optimists who went out on a limb by spending money to

ramp up production.

- I used the phrase above “highly

optimized operations.” By that I mean the mines were focusing

only on the easy-to-mine, higher-grade material that would allow

them to produce a return... maybe. It also meant they were extremely

frugal, reluctant to buy new equipment, or hire the bare minimum

of employees.

- Another survival technique

was the selling of future production at a set price, a perfectly

rational exercise in a bear market, because it at least assured

a price that would cover the known costs.

When you add all that together,

especially the inherent skepticism of management, it becomes

easier to understand why it was that the industry was slow to

act even as the gold price started moving up. In fact, it was

only in February 2003, with gold trending over $350, that Barrick

Gold Corp., the world’s largest, began the expensive process

of unwinding its hedges. And it wasn’t until November of

that year that the company announced it was foregoing forward

sales altogether and would work to bring its hedge book back

to zero.

At the point that the industry

realized that the bull market in gold was for real, it started

to scramble to play catch up. Which, in a choo-choo industry

like mining, means hiring and training lots of people, buying

and refurbishing the equipment needed to reestablish production

on more marginal deposits, upgrading facilities, building expensive

new mills, etc., etc. And, of course, dealing with the cost of

unwinding hundreds of millions of forward hedge contracts.

The rebuilding of the gold

mining industry, in short, really only began in earnest over

the past few years. As would be expected, the costs associated

with this rebuilding required big hits to the financial metrics

that institutional investors look at before making an investment

decision.

The metrics were not helped

by the shift away from high-grade ore (the lower the grade, the

more the material you have to process)or generally rising inflation

and a falling dollar. The end result was that the cash cost of

production rose by as much as twice what it had been during the

mothball years, keeping the margins tight and the miners unattractive

as investments.

By contrast, the base metals

companies bottomed much earlier, in late 1998 and the first quarter

of 1999, thanks to increasing demand out of China and elsewhere.

As a result, they were well on the road to recovery when the

big price increases for base metals began in 2004, positioning

them to make free cash flow hand over fist. Thus, while the gold

miners have been largely shunned in recent years, the base metals

sector has been enjoying salad days, reflected in multi-billion

mergers and acquisitions and, of course, sharply higher share

prices.

Here at Casey Research, we

are of the firm opinion that now that the worst financial aspects

of restarting their industry are behind them, the big gold companies

are poised to take off. Proof of this point should come in rapidly

improving margins which, lo and behold, we have begun to see

in the quarterly reports now being released. Just this week we

have learned that Goldcorp’s profits almost quadrupled last

quarter, Barrick’s net profit rose by 28% last year and

is expected to build rapidly from here and Kinross has just posted

a record quarter, with profits up almost three-fold over the

same quarter a year before.

The exception to the pack was

an announcement that Newmont lost $933 million in the last quarter.

But even there we find confirmation, because the loss was mainly

associated with a one-time write-down of costs associated with

acquiring new reserves and closing down an unprofitable merchant

banking operation. In sum, Newmont took the write down because

they could afford to, and because the high price of gold would

help mute any investor disappointment. In essence, they have

effectively cleaned up the books in order to join the profit

party.

We will not long be alone in

noting the pending improvements to the bottom line of the big

gold companies… the investment herd is coming and, we expect,

coming soon.

Now, I am going to dig down

one more layer to make a couple of points you may consider blatantly

commercial. Be that as it may, I’m not going to shy away

from making these points simply because Casey Research will benefit

if you take the action I’m going to recommend.

The first point I want to make

is that if you don’t already have a subscription to BIG

GOLD, now is the time to take one. Our number-one pick, Kinross

Gold, has already bucked the trend by moving up over 68% in the

last 9 months, but the show is just beginning. The underperforming

big gold companies and the new producers we are following, are

going to catch up in a big way and soon. If you haven’t

yet subscribed, do yourself a favor and do so today. You can

subscribe today for just $79 a year, and your subscription comes

with a 3-month, 100% money-back guarantee, so you have less than

zero to lose.

Click here to learn more about

BIG

GOLD and to subscribe.

The second point I need to

make has to do with the junior exploration companies.

History has proven that, other

than discovery stories, the big gold stocks need to get in gear

before the investor sentiment reaches the critical mass needed

to spill over into the junior sector. History also shows that,

as profitable as the big gold companies are in a bull market,

the returns offered by the juniors can blow those away. Exponentially.

This upside, of course, comes with a greater degree of risk.

As the existing subscribers

to the International Speculator will attest, these stocks

can move down just as fast as they can move up… but if you

have the tolerance for volatility and invest only with money

you can afford to take a 50% (or more) haircut on, then you absolutely

have to take a subscription today, while the bargains are still

available. Again, we offer a discounted new subscriber rate and

a 3-month guarantee… meaning you lose nothing by giving

it a try.

Click here to learn more and

to sign up for a subscription to the International

Speculator now.

If you have the means, you

really should have both.

While that may be the most

blatant pitch I have ever made in this missive, I hope you can

appreciate that I believe every word.

In fact, I have never been

more bullish on the gold stocks in my life. That doesn’t

mean I’m right, but you can rest assured that I am completely,

entirely sincere. We have a great team here, all of whom work

very, very hard to get things right. Which, generally speaking,

we do. Right now, the single best recommendation I can give you

is to get very serious about your gold stock portfolio. Know

why you own each stock you do, and don’t bet the family

farm, but be bold and the payoff should be truly extraordinary.

I don’t think we are going

to have long to wait for the show to really get on the road.

Spy vs. I

An outraged instant message

from Fitzroy MacLean of Without Borders, our international

investment and lifestyle letter, popped up on my screen earlier

this week. Now, given that Fitzroy used to earn his porridge

by engaging in covert and overt operations where a failure in

risk management could lead to a bullet in the head (he is former

CIA and an Army Ranger), he is not easily flapped, so his strident

message caught my attention.

He was writing me from Germany

where the news had just broken that German intelligence officers

had paid on the order of US$5.9 million to a Liechtenstein bank

employee to steal a disk containing the names of all the German

account holders of the bank (and, I suspect, everyone else…

giving the German government a very nice trading card). The purpose,

of course, was to crack down on anyone who had been trying to

avoid taxes by stashing funds in that tax haven.

Now, unlike Fitz who was appalled

that the country’s intelligence services were being put

to work spying for the tax department, some of you may think

that it is good and proper that the tax cheats are being rounded

up and hauled off to the cells. If so, then you’ll have

much to cheer you in the months and years just ahead.

The fact is that governments

in all their many permutations are themselves starting to feel

the pinch from their overspending and overcommitting to spend

more. The pinch will turn to a vice grip as the flaws of the

fiat monetary systems they uniformly deploy begin to collapse

as they futilely try to keep the dyke from bursting.

In the United Kingdom, for

example, the government has made the decision to nationalize

the failed Northern Rock bank at a cost of almost US$7,000 per

citizen. And in Germany, you have a bailout now approaching US$2

billion underway for the 1KB bank.

But this is only so much kinder-play

when compared to the U.S., where the banks have been lining up

around the block to take advantage of the Fed’s Term Auction

Facility (TAF). Which is to say, the banks are handing the Fed

a bunch of toxic waste as collateral and receiving, in return,

tens of billions of freshly minted dollars at a very agreeable

interest rate.

And even that doesn’t

begin to measure up against the $170 billion of handouts contained

in the stimulus package.

Which pales in comparison to

the larger 2008 budget deficit, now estimated to be over $400

billion.

But all of that is only a splash

on the rim of the bucket against the tens of trillions of bills

now coming due for the benefits due the retiring baby boomers,

a number sure to go higher when President Obama rolls up his

well-pressed sleeves to implement universal healthcare…

and… and…

The pressure is beginning to

be felt all the way down the chain. In California, Governor Schwarzenegger

attracted a lot of unhappy attention by suggesting the state

start letting criminals out of jail, cutting welfare and closing

down public parks and other facilities because that once golden

state could no longer afford the bills. Here in Vermont, the

governor has proposed selling the state’s lottery to raise

some pocket cash.

Make no mistake, we are still

in the early, more friendly phase of this process. Once the state

really starts to come under pressure, it will do whatever it

takes to keep afloat.

A relevant comparison, sadly,

comes from ancient Rome. During his unhappy term in office, Roman

Emperor Caligula first spent the treasury dry, then, after it

was depleted, turned to doing whatever it took to keep the state

afloat. Which, at that time, involved – among other activities

– accusing the wealthier citizens with treason followed

by a speedy trial (“Hail Gaius! You’re guilty, off

to the lions with you. Have a nice day!”) and the confiscation

of all their property. As things slipped further down the slope,

he passed into law incentives whereby friends, relatives and

fellow countrymen of said property owners could rat them out,

for which they would receive a cut of everything confiscated.

And, one would imagine, as a bonus get a front-row box seat to

watch the lions eat.

Expect to see more and more

of the sort of covert activity engaged in by the Germans spread

around the globe. We are at the beginning of the trend, not the

end.

Watch yourself.

And Now for Something Entirely Different

As you know, at this point

we are avoiding traditional equities (except to short some),

and have no interest in fixed income. But we are birds of a different

color than most investors, being determined contrarians with

a solid speculative bent.

For those of you who skew a

bit more toward the traditional, you might appreciate reading

some of the material put out by Fidelity Independent Advisors.

Olivier Garret, our CEO, and I met Fidelity’s Don Dion at

a conference last year and were impressed. While I personally

wouldn’t rush into some of the sectors they follow, you

might be more inclined in that direction. If so, check out their

free Hotline e-letter by clicking

here…

Energy Chart of the Week

By Chris Gilpin

Contributing Editor, Casey

Energy Speculator

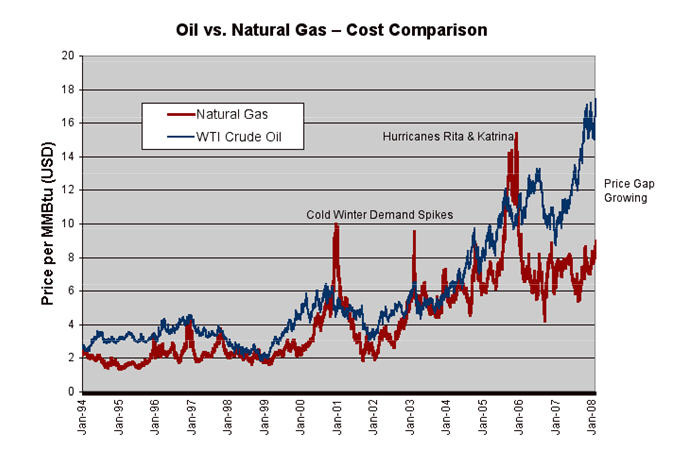

For the past three years, there’s

been an unusual divergence between the prices of oil and natural

gas. Historically, the price per unit of energy between the two

fuels is roughly equal. It might swing apart during cold winters

when natural gas prices sometimes spike, or during times when

political tensions in the Middle East put a “terror premium”

on crude prices, but all things considered, they usually fall

back into alignment.

That’s because several

large industries, and some power plants, have the capacity to

switch back and forth between the two fuels. With crude costing

twice as much per million British thermal units (MMBtu) as natural

gas, you can rest assured that no one is burning petroleum products

to power their operations or feed the electricity grid, not if

they can possibly help it.

This widening price gap poses

a pressing question: is oil overvalued, or natural gas undervalued?

Both, is the most likely answer.

What’s most fascinating

is that this graph also clearly shows that the price of energy

per unit – no matter what the fuel source – is rising

sharply, proof that the global energy boom is in full swing.

(Ed. Note: If you are

looking to get in on the energy boom, that is a sector we follow.

You can learn more about the Casey Energy Speculator by

clicking

here.)

The Mailbag

I had any number of interesting

reader emails this week. Here are excerpts from a few I thought

you’d find of interest…

“You recommend highly

speculative stocks. Given the respect you carry in the industry

and the size of your readership, I am concerned about the timing

of when you believe it is time to get out of the precious metals.

I wouldn't think your exit would have much of an effect on gold

or silver, per se, but I would like your honest and transparent

belief over how much your "sell signal" will affect

those small and highly speculative precious metal mining companies.

I think it will be substantial, and frankly, I believe this precious

metals bull market may last a lot longer than you seem to think

from your writings. I don't want to be caught holding the bag,

waiting for a small company to come back from carnage that could

ensue when you guys recommend getting out.

Bottom line: How big of an

effect do you think your sell signal will have on those stocks?

An excellent question and a

welcome sign of a heads-up investor paying close attention to

their personal knitting.

The answer, generally speaking,

is that we expect the serious Mania phase in the gold stocks

to last at least a year. At some point in the run up, likely

six months or so into it, we are going to come to the conclusion

that the Mania is headed toward its apex and recommend our subscribers

begin looking to lock in profits by selling into volume.

Remember, this is pure conjecture,

because it is impossible to say with any certainty what market

conditions will be like at the time that we begin to feel the

Mania is reaching full stride.

However, as the subscriber

just quoted so aptly points out, inherent in the discussion above

is the fact that, yes, we are likely to put out the sell signal

well before the bull market run is over. That should, we would

hope, allow for an orderly exit, over a leisurely period of time.

Will our recommendation to take profits at that point cause the

stocks we follow to take a big hit?

Impossible to say – as

much will depend on whether you, the subscribers, decide to rush

to the exits, and what the level of the volume is coming into

the stocks at that time. I don’t think there is much chance

of a mass exodus, however, because it is human nature to hang

on longer than is prudent. With markets being in full bloom at

that point, the odds are that most of you will want to hang around

in the hopes of yet another double.

The best way, as always, of

viewing our services are as a source of unbiased, deeply considered

research on investments to potentially include in your portfolio.

But how you manage your portfolio has to remain an entirely personal

activity. When you get a 3- or 4-to-1 shot, we would suggest

you do yourself a huge favor and, no matter how exciting the

party, don’t wait for us to tell you to scrape your original

investment and a handsome profit off the table.

This is, of course, a topic

we will continue to address over time. For now, however, we are

still very much in the portfolio-building phase.

Hi David,

I wanted to share a story with

you that I found quite shocking and relevant to many of the topics

surrounding the current financial predicament this country now

finds itself in.

Since I travel just about every

week all over the country, visiting and working with our various

customers, I try to get a gauge on how the current financial

situation is affecting average working Americans. As part of

the general IT strategy work we do, we typically do a great deal

of process re-engineering work as well. As I have been recently

working with a client in a very rural area, we have focused a

lot of our efforts trying to eliminate many HR-related inefficiencies

in their organization.

As a result of some of the

preliminary workshops we ran the first week, I was shocked to

find out that at the current client, their 401(k) plan has witnessed

a dramatic drop in the number of participants in the plan over

the past 3 years, from a high around 59% participation back in

1998. At present they have about 28% of their employees who opt

in to the plan. However, only 23% of the employees contribute

the full 100% tax-deductible contribution which the company matches

at an average rate. On top of this, their HR department has recently

added money management classes due to the number of their employees

that now find themselves in an ever-increasing pile of credit

card-related debt and in a few cases, bankruptcies.

This is just one example of

the plight of Americans and the current negative savings rate

which we are witnessing now. Given that this is the second-largest

employer here in the area, in my mind this is probably a fairly

good representation of the overall community at large. Oddly

enough, the local Super Wal-Mart was jam packed with local shoppers

purchasing everything from flat screen TVs, to groceries and

iPods.

So as much as I would like

to think that most of these folks who choose not to participate

in their companies' 401(k) plan was out of sheer financial hardship

and necessity, I am driven to conclude that there are a lot of

people out there who simply do not know how to manage their money

properly and just make stupid decisions? It would be interesting

to see what these averages look like on a national basis?

Just thought I would share

that with you.

Human psychology is very complex.

You would think, given that their employers were willing to match

funds, and that the money saved has tax advantages, people would

happily contribute to their 401(k) plans. It is, however, a well-documented

fact that people make financial decisions that don’t make

any sense.

I also believe that decades

of intonations by politicians that the citizenry will be looked

after has, in my opinion, led people to an unrealistic view of

their future, and a naïve belief in the ability of the government’s

safety net to hold up when they are ready to plop into it. In

fact, I think the biggest problem this country will ever face

will be the problem of the indigent elderly… 20 or 30 years

down the road.

Regardless, there is a new

book out on behavioral economics – i.e., what people actually

do with their money, rather than what the economists think

they should do. It’s entitled Predictably Irrational

by MIT professor Dan Ariel. While I haven’t yet read it,

I heard Ariel interviewed yesterday and found his experiments

about how people make financial decisions very interesting. He

used as an example the decision making that goes into deciding

how much to pay for a piece of chocolate. You put the chocolate

in your mouth and it melts, creating an enjoyable taste sensation.

But what process determines how much you are willing to pay for

that sensation? I plan on reading the book.

A unique site. When you click

on the website link below, a world map comes up showing what

strange & dangerous things are happening right now in every

country in the entire world & is updated every few minutes.

You can move the map around, zero in on any area & actually

upload the story of what is going on. This “map” updates

every 300 seconds... constantly 24/7.

http://www.globalincidentmap.com/home.php

Click on any icon on the map

for text update information. It's not just about terrorism -

it's about everything happening every minute some place in the

world of terrorism threats, explosions, airline incidents, etc.

Pretty cool, if accurate. For

instance, you would have thought we would have heard something

in the main street media (or “lame street media,” as

some like to call it) about the Indians being arrested while

smuggling uranium. I just googled it, and sure enough, there

it is. In fact, if media reports are right, this is the second

such incident in India in recent years. As if Pakistan doesn’t

have enough trouble…

MISCELLANY

Think Your Laptop is Small? In a recent edition of these ramblings,

I shared my general optimism about the future of humanity, thanks

to steady technological progress. That is, of course, a theme

often referenced by Doug Casey, the chairman of this organization

and my favorite partner of all times. Doug is looking forward,

especially, to the era of nanotech, when all things will be possible.

While waiting, we can entertain ourselves with a steady stream

of cool new stuff. Here

is a link to one of the coolest I have seen of late…

Speaking of Laptops… if you are traveling internationally,

you may want to give consideration to the idea that the local

border clerks – you know, the ones with the warm smiles

and hand guns – may take an unhealthy interest in your laptop

and decide they should have a poke around, or just confiscate

it outright. Some

words to the wise here…

The Stella Awards for 2007

are out (www.stellaawards.com).

These are the prizes awarded for the most frivolous lawsuits,

named after the woman who sued after burning herself on a cup

of MacDonald’s coffee. Here’s the 2007 winner…

Roy L. Pearson Jr. The 57-year-old

Administrative Law Judge from Washington DC claims that a dry

cleaner lost a pair of his pants, so he sued the mom-and-pop

business for $65,462,500. That's right: more than $65 million

for one pair of pants. Representing himself, Judge Pearson cried

in court over the loss of his pants, whining that there certainly

isn't a more compelling case in the District archives. But the

Superior Court judge wasn't moved: he called the case "vexatious

litigation," scolded Judge Pearson for his "bad faith,"

and awarded damages to the dry cleaners. But Pearson didn't take

no for an answer: he's appealing the decision. And he has plenty

of time on his hands, since he was dismissed from his job. Last

we heard, Pearson's appeal is still pending.

This is not a new story, but

it is instructive, nonetheless… I knew a judge once who

was crazy as a rabid rabbit. Eventually, he too was dismissed

after getting caught climbing into the window of his ex-wife’s

house, gun in hand.

About that Ethanol Stuff. We have made derisive noises about

the etha-not boondoggle that is costing you a lot of tax dollars

and helping to drive up the global cost of food (33% of all the

corn grown in the U.S. is expected to be used for the stuff over

the next decade). Well, recent news has it that the demand for

ethanol not only pushed up the price of food by 4.9% last year,

but that it will double the level of greenhouse gases produced

over the next 30 years. Okay, now let’s see how long it

takes before the politicians pass a law which, in principle,

explains, “Oh, about that ethanol stuff… well, hmm,

never mind.” I’m betting it will take a decade, at

least.

Protectionism Watch.The last thing the world needs right

now is a trade war. But, as I have commented on previously, it

may soon get one. The latest sign comes from the Australian government,

which is looking to pass legislation that requires that sovereign

wealth funds are “independent from the relevant foreign

governments.” I wonder what part of the term “sovereign”

our friends down under don’t understand? Meanwhile, Beijing

is none too happy following a decision by a U.S. government panel

to disallow a Chinese state company, in conjunction with Bain

Capital Partners, to buy 3Com Corp. This sort of thing is happening

fairly frequently now, and the pace should only accelerate as

people get more nationalistic, urged along by politicians looking

to assign blame for economic woes anywhere but where it actually

belongs.

That’s It For This Week!

There is much, much more one

could comment on… the failure of auction debt markets (yesterday

395 out of 641 auctions failed. To get a sense of what that means,

consider that since the auction debt market was established in

1984, there had been a total of just 44 failures); the shooting

down of errant satellites; the burning of embassies; the invasion

of our friends the Kurds by our friends the Turks… but there

is only so much time in the day, and other responsibilities call.

A quick check of the screens

show that gold is holding strong at $944, oil is $96 and the

U.S. stock market is, again, down almost 100 points. Business

as usual, I’d say.

Until next week, thank you

for reading!

David Galland

Managing Director

Casey Research, LLC.

###

Doug Casey

Casey Archives

321gold Ltd

|