Casey Files: Casey Files:

Will Gold Crash in a Recession?

By Bud Conrad & David Galland,

Editors

BIG

GOLD from Casey Research

Jan 28, 2008

From the 1990s until today,

Americans have maintained their life style by borrowing. As the

American consumer is about to find out, the bill for that life

style is coming due.

So where will that lead the

U.S. economy? Simply stated, surveying the landscape of current

events, many of which are a direct consequence of excessive debt

and an inevitable slowdown in consumer spending, we expect stagflation

ahead. Loosely defined, that term refers to a general economic

slowdown - a recession - but coupled with rising prices triggered

by massive infusions of liquidity into the market.

That liquidity can come from

governments - witness the billions upon billions now being thrown

into the fray by the world's central banks - or it can come from,

say, some percentage of the 6+ trillion in U.S. dollars held

by foreigners coming home to roost. On that latter point, in

recent weeks there has been almost daily news about foreign corporations

and sovereign wealth funds unloading their greenbacks in exchange

for shares in some of America's largest financial institutions.

Doug Casey has correctly pointed out that it is when the trade

deficit starts to shrink, which it recently has, that you need

to look for cover... because, among other things, it means the

tide of U.S. dollars is beginning to wash back up on U.S. shores.

Our view that the stagflationary

scenario is the most likely is supported by a steady stream of

data. For instance, despite an obvious slowdown in 2007 holiday

season shopping, the Bureau of Labor Statistics reports that

producer prices in November increased at the fastest rate in

16 years.

Rising prices make a stagflationary

environment positive for gold, if for no other reason than that

investors reallocate depreciating paper-backed investments into

tangibles with a demonstrated ability to float as the intangibles

sink.

So, our view remains that we

are headed for a stagflation. But what if we are wrong?

What happens if the global

economic crisis gets so bad that it trumps any and all inflationary

influences and we enter a straight-up deflationary recession?

That is, we are sure, a question

on the minds of many gold investors.

Some quick thoughts...

Gold in a Recession

Traditionally, gold has been

a safety net against inflation. Inflation is good for gold, a

case we don't need to make again here.

But, in a typical recession,

the demand for everything slows and the prices of many things

fall. The knee-jerk reaction of most casual market observers,

therefore, might be that if inflation is always good for gold,

then the opposite is always bad.

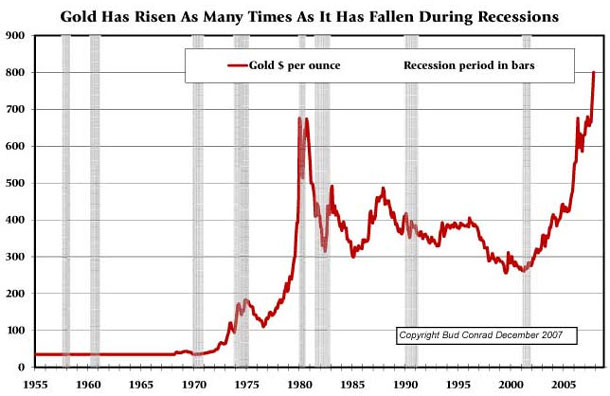

Historically, however, that

is not the case. The chart below shows the price of gold overlaid

against official periods of recession as defined by the National

Bureau of Economic Research. As you can see, about half the time

gold actually rises in a recession.

(Note:

this chart uses monthly averages, so you can see that current

prices are,

(Note:

this chart uses monthly averages, so you can see that current

prices are,

in nominal terms, higher than the 1980 high, based on those averages.)

Simply, there isn't a specific

historical precedent that demonstrates that gold will fall during

a recession.

But could we have a general

deflation, one that might tip gold into one of the down cycles?

Of course.

The developing recession, based

as it is on a global contraction in credit, looks to be especially

long and deep. Almost daily now we learn of multi-billion-dollar

debt defaults. Those, in turn, trigger both a freeze-up in easy

credit and a flight from risk.

In response, the government

has responded with its predictable "fix-it" tools -

stimulus and bailouts. The tools of government stimulus are lowering

the Fed funds interest rate, and potential new large-scale bailouts

like the Resolution Trust Corporation (RTC) that was put into

action to straighten out the Savings and Loan crisis of the 1980s,

to the tune of $200 billion. While the Europeans have just unleashed

an amazing $500 billion in new liquidity, so far, U.S. Treasury

Secretary Paulson and Fed Chairman Bernanke and friends have

been surprisingly slow to act. They started with denial and have

moved to inadequate band-aids.

In the absence of any concentrated

and well-funded program - such as the RTC - to try and keep the

wheels on (and, at this point, it is not clear that any imaginable

measure will suffice), the deflationary pressures of the housing

collapse are winning.

But there is an important,

longer-cycle pressure that is not talked about much, although

it is increasingly obvious to the American consumer: the dollars

they're spending are buying less. They see gasoline and heating

prices rise, but don't think much about the dollar itself as

the underlying source of price inflation.

This decline in the purchasing

power of the dollar is extremely important for the price of gold.

That's because the pressures on the dollar seem overwhelming

when aggregated: huge budget and trade deficits, wars and retirement

demands of baby boomers, unprecedented foreign holdings of U.S.

dollars. Watching the prices of internationally traded goods,

including oil at $90 per barrel and wheat at a record $10 per

bushel, it is hard to imagine a situation of serious deflation

emerging.

Looking for Alternatives

The flight to quality by investors

who no longer trust packages of mortgage loans, or anything that

is not strictly labeled as government backed, is unprecedented.

The interest rate on government-issued two-year Treasuries dropped

to 3%, reflecting the demand for safety. Concurrently, other

interest rates have risen in response to increasing mistrust

and uncertainty.

Gold, of course, provides a

different form of safe harbor alternative - an asset that is

not only readily liquid but, unlike government paper, positively

correlated with the very same inflation that will erode the purchasing

power of paper assets.

Right now, gold is not on the

front burner, but this is only to be expected because of the

state of flux of global financial markets. Like observers of

a war of Titans, the market is confounded by the sheer magnitude

of all that is going on, from the devastation being wreaked on

the world's best-known and most established financial institutions,

to the unleashing of billions upon billions in experimental new

liquidity measures by central banks.

As the fog of war begins to

clear and it becomes obvious that not only will economic growth

be severely curbed, but that the fiat currencies are going to

be sacrificed in the fight, some percentage of the funds now

sitting on the sidelines - much of it in U.S. Treasuries - will

begin to move into gold and other tangibles. In the face of limited

gold supplies, this surge in demand should create strong upward

pressure on the price of gold and, for leverage, gold shares.

In sum, even though the relatively

sluggish and inept responses from the U.S. government in the

face of the current credit crisis could produce a severely slowing

economy, creating periods of deflationary fears that put stress

on the price of gold, we continue to believe that the most likely

case is for massive inflationary bailouts that support a positive

outlook for gold.

###

FREE BIG GOLD REPORT: As a special offer

for readers, and so you can see the value of this unique publication

for yourself - for a limited time - Casey Research is making

a BIG GOLD special report available absolutely free of charge. FREE BIG GOLD REPORT: As a special offer

for readers, and so you can see the value of this unique publication

for yourself - for a limited time - Casey Research is making

a BIG GOLD special report available absolutely free of charge.

"The

Golden Triple-Play: A Gold Stock, Mutual Fund and ETF"

contains everything you need to know about profiting from three

of today's best gold investments.

To learn more

and to request your copy of this free report, click

here now.

Bud Conrad

and

David Galland are, respectively, the chief economist and

managing editor with Casey Research, publishers of BIG

GOLD,

an inexpensive monthly advisory dedicated to providing unbiased

and actionable research on simple, effective and cautious ways

to participate in rising gold markets.

Each month

subscribers receive a comprehensive but comprehendible overview

on the economy and gold markets, plus detailed recommendations

on the best ways to invest, including producing and near-production

gold stocks, mutual funds, gold ETFs, e-gold alternatives and

much, much more.

Doug Casey

Casey Archives

321gold Ltd

|