|

|||

Will the US$ Break Down?Brian Bloom For twenty five years (since 1982) I have held the view that the World's Central Banks operate in unison to 'manage' the international markets in general and currency markets in particular. There was a short period after 1987 when, for a while, it looked like things might spiral out of control. On the day of the 1987 crash my attention was riveted to the computer screen. The Australian equity market took a 25% dive in about three hours. In the ensuing days and weeks I watched a parade of high profile captains of industry being rolled out in front of the TV cameras. To a man, they all said "No worries mate. She'll be right." It turned out they were right. From around 1989 the markets started to stabilise again, but we had to weather some scary times. Then, in 1999 - after the Nasdaq had experienced a speed wobble - I started to feel as if this mental model of mine was fraying at the edges again; that the Central Bankers might be losing it. Y2K was in sight. A level of hysteria was starting to build (similar to that currently raging regarding CO2 and Global Warming). The world was going to fall apart according to the experts in the IT industry. "Fear" became a commodity which the media eagerly exploited. Tentatively, I put my toe in the gold water and bought some gold shares - when gold was around US$280 an ounce. Quite a few gold shares, actually; around 10% of my net worth. I saw it as an insurance policy. My stomach was in a knot. From that point on I have been watching the markets like a hawk. The reason was that whilst I understood what the Central Banks were trying to do, I had a clear memory in my mind of having funded my Post Graduate University fees from profits I had made by selling short into the 1969 crash - a crash from which it took over a decade to recover. When the market decides to turn, no force on Earth will hold it back. If/when the market decides to turn this time around, the Central Banks will get smashed against the jagged rocks of the debt and derivatives mountains. But the flip side is that the debt and derivatives mountains will begin to implode, and the entire world's financial system will face a high risk of unravelling. It will be the stuff of nightmares. We absolutely do not want the markets to head either north or south from this point. East will be great. It will allow us to regroup over time. Understanding this, on 6th August 2002 I stuck my toe in the water again. I wrote an article entitled "A Bull Market in Gold - The Flip Side". You can read it at http://www.gold-eagle.com/editorials_02/bloom080502.html Yes, I was worried in 2002, but I was also fairly heavily invested in gold. So I became a schizophrenic. On Mondays, Wednesdays and Fridays I was cheering the gold price, but on Tuesdays and Thursdays I prayed that the Central Bankers would be able to hold it all together. My portfolio has been rising strongly in value even as my nerves have become increasingly frayed. I have since diversified away from some gold shares so as to keep the ratio to net worth at 10%. I still see gold as an insurance policy but, increasingly, I am focussing on gold as an exceptionally valuable commodity because of its ability to "power" new technologies. If you and I had been managing our personal affairs the way the Central Bankers appeared to be managing the world economy, we would probably have been thrown in the dungeon and the jailer would have thrown away the key. Maybe, if he was feeling benevolent, he would have fed us once a week. Against the benchmark of values which my parents had drummed into me as a kid, I have been sickened to my stomach to see how the so-called leaders of society have morphed into lying, cheating, grasping egomaniacs who have barely stopped short of plundering the people whose interests they had been elected to protect. The ethical fabric of society has been ripped asunder. Enron was the tip of an iceberg. LTCM was a zephyr breeze on a cloudy day. Recently, the Bear Stearne's debacle gave rise to a small crack in the dyke which the authorities are attempting to paper over. No mention has been made of the linkage of the sub-prime mortgage portfolio to the derivatives markets. My understanding is that there is a combined risk exposure of US$60 trillion in the derivatives markets - greater than one year's GDP for the entire world. The issue here is not whether or not the books are balanced. It relates to counter-party risk. Will the guy on the other side of the contract honour his obligation? Alan Greenspan, an American Citizen, was knighted by Her Majesty Queen Elizabeth II. He was rewarded with the highest accolade for that which my old man would almost certainly have punished me. What did Sir Alan do? Well, heres a short list:

When the gold price got to $550, I became alert to the possibility that the Central Banks might become more aggressive. The price shot up to $720 an ounce and, as my gut had been telling me, some heavy selling came in and the price fell all the way back to $545 again. That was in around May 2006. Since then, in my imagination, I have been watching a battle raging between "the market" - which seems to want the gold price to rise; and the Central Banks - which seem to want to prevent a breakout to new highs. The following Australian Dollar version of the monthly gold price chart is very revealing. It shows strong resistance to further rises at the point at which the Gold Price peaked a few months ago. (source: http://www.gold.org/value/stats/statistics/monthlysince1971.html)  This particular chart was a bit of an eye opener to me, because it implied one of two things. Either:

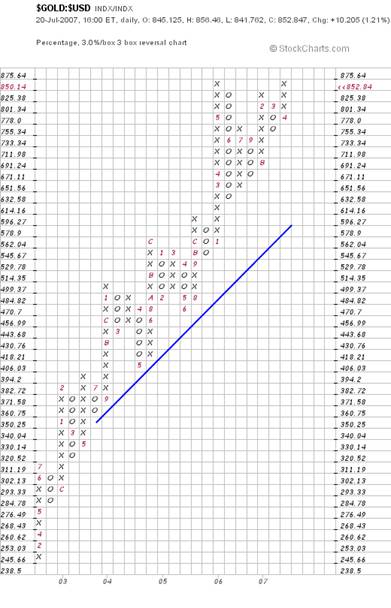

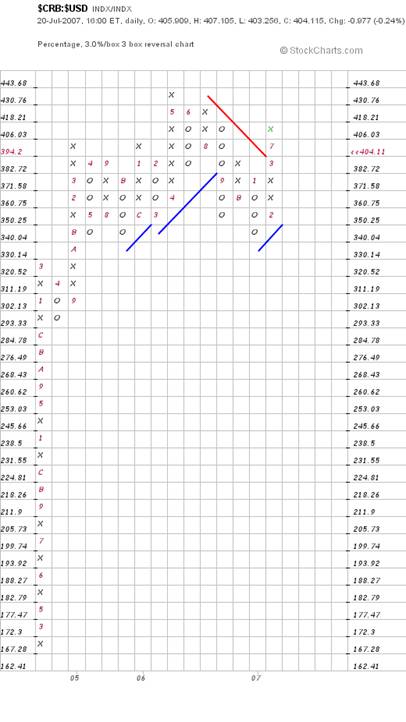

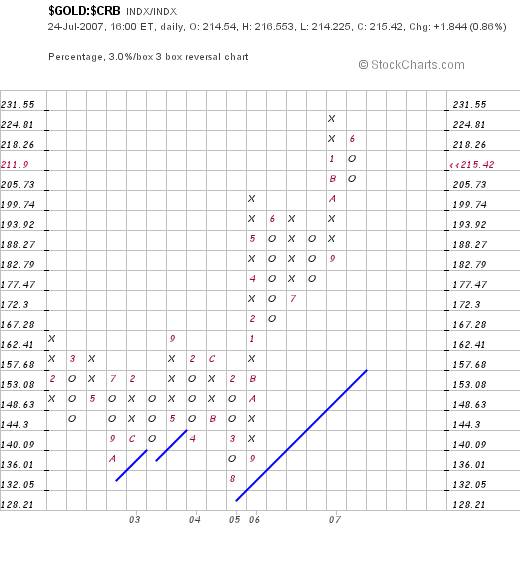

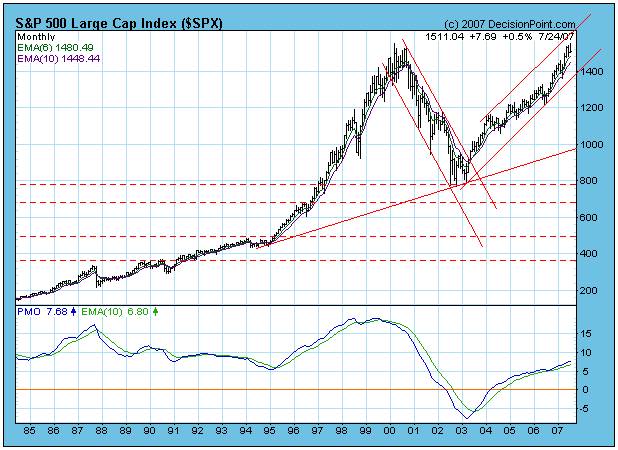

Will it explode upwards in US$? From the relative strength chart below (courtesy stockcharts.com) it is clear that the ratio of the dollar gold price to gold has reached a double top from which it must either break down or break up strongly.  By contrast, if we view gold as a commodity, then the Commodity chart below does not look particularly strong relative to the US Dollar. i.e. The Dollar does not look like it wants to break down relative to commodities in general.  Also, although the gold price is strong relative to commodities, the ratio has reached its short term price target based on the horizontal count technique.  By contrast, reference to the following weekly chart shows that share investors seem to be building an enthusiastic head of steam - i.e. The ratio of $XAU:$Gold has been rising strongly  Nevertheless, the ratio also seems to be hitting resistance of the 200 week MA, and both the RSI and the MACD look mildly overbought. If I had to guess, my guess would be that this time around, the gold price will fail to penetrate the $700 mark. Conclusion As per my last article, wherein I forewarned that there was room for the Central Banks to suppress the gold price, this outcome looks likely in the short term based on relationships which are not immediately obvious by means of standard technical analysis approach. Gold bugs are in for a rocky ride. The question arises: Will gold breach the $700 level within the foreseeable future? For the answer to this question, I refer the reader to the weekly chart below - of the goldollar index. (Courtesy decisionpoint.com)  What we see here is a classic triangle pattern in the goldollar index which, in a Primary Bull move is typically viewed as bullish. What this means is that the US$ Gold Price multiplied by the US$ Index seems likely to break up. When we look at the following daily chart of the US Dollar (courtesy yahoo.com) we see a falling wedge pattern which, in a Primary Bull market is bullish, and in a Primary Bear Market is Bearish.  Clearly, the US Dollar is at a critical juncture from a strategic perspective. If it breaks down from this falling wedge (and readers should recognise that it could have a false breakdown if speculators mount a raid against the US$) then this will imply that the Primary trend of the US Dollar is down. Under circumstances such as this, gold might be perceived as an alternative currency, and the gold price might rise faster than the US Dollar Index will fall. In this case, the goldollar triangle will break up, but the world (equity and commodity) markets will likely enter a period of turmoil. At present, from the monthly chart of the Dow Jones Industrial Index there is no sign of this.  However, as has been opined by this analyst before, there is a distinct possibility that the DJIA has been "ramped" because the monthly S&P chart below is showing a potential (bearish) double top.  In light of all of the above, we are facing an extremely dangerous period over the coming weeks as the Central Banks (acting in unison) attempt to prevent a US Dollar collapse. Overall Conclusion If my mental model remains intact, this is the outcome I would expect to see over the next few weeks:

Fall back position If the Central Bankers fail to support the US Dollar, gold will fall as a commodity, but will likely soon rise because of its "perception" as the currency of last resort. Author's comment: My personal view is that the Central Banks will throw everything but the kitchen sink at the dollar, and they will succeed for one reason: When the world was on a gold standard, one dollar represented one dollar, plus the multiplier effect probably took its "horsepower" to (say) $5 When the world went onto a fiat standard, the horsepower of $1 became $13 because of growth in money supply and the multiplier effect that flowed from looser monetary policies Since the world lost its marbles and embraced the derivatives industry, one dollar in the hands of the Central Bankers can be ramped to have the power of (say) $100. The Central Bankers have a bottomless pit of resources to play with - provided the derivatives market does not unravel. Which brings us to Bear Stearns. That particular story is in its infancy, but my guess is that we haven't heard the last of it. The cracks will continue to be papered over; at least until the US Presidential elections are behind us. Ultimately, however, the problem revolves not around whether the Central Banks can hold it together with money. The short answer is that the day will come when they can't. The question revolves around whether or not our politicians will facilitate a migration to new energy paradigms - which is why this analyst is also focussing on that particular subject. Brian Bloom

Beyond Neanderthal Via the medium of its light hearted storyline, it examines how the world has gotten itself into the horrific quagmire of economic and social problems with which we are now faced - and puts forward one possible course of action on which we might embark to dig ourselves out. It may be ordered over the internet via www.beyondneanderthal.com. Or purchased from Amazon. |