|

|||

Volatility in the Bull MarketMary Anne & Pamela Aden

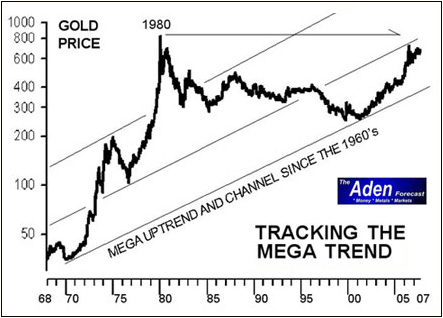

The commodity markets were bubbling this past month. Oil, lead, wheat and the CRB index closed at record highs and tin reached an 18-year high, driven by China's fastest growth since 1994. Volatility then set in as the subprime woes affected the commodity markets, but China and the world's demand for raw materials is the key to the ongoing bull market rises. Double-digit growth in China and a global economic boom of unprecedented proportions will continue to support the base metals, raw materials and precious metals for years to come. That's why it's important to stay focused on the big picture. It's easy to get caught up in the volatility and wild swings in the market if you don't have a strategy and plan for the big picture. Take crude oil as an example. Its "up like a rocket and down like a stick" volatility has been unnerving, but oil is actually strong above $70 and any volatility above this level is par for the course. The reason oil fell from $78 was due to the concern that a slowing economy would reduce demand. This fall wiped some of the froth from the market, but oil's still strong and the bull market is intact. Gold is another good example. It hasn't reached a new high for 14 months, yet the major trend is solidly up. And on a big picture basis, the gold price is strong near the 1980 highs and it's wide open to future rises (see Chart). This reinforces that the commodity move is well on its way in the mega rise.  Gold is a safe haven. It rises when there is uncertainty or war in the world, and during inflationary times. Investors, for instance, turned to gold following the huge hedge fund losses at Bear Stearns. Gold initially fell on concern of a slowing economy, but in reality this would be good for gold. A slowing economy would likely keep the Fed from raising interest rates, thereby weakening the dollar and boosting the appeal of gold. Demand is also growing not only for investments and jewelry, but also from the central banks who were previous sellers. Countries like Russia, Argentina and South Africa are buying gold for their reserves. In July, Qatar announced it had increased its gold holdings 15 times since last year. China has one of the lowest gold holdings at about 1.1% of total reserves. All they would have to do is increase this by a few percentage points and the gold price would potentially soar. Keep an eye on $642, the 65 week moving average. This is the major 6 year bull market uptrend. Let's see how gold fares now that the slow Summer months are coming to an end. The Fall is normally a good time for gold. Jul 24, 2007 For more information, go to http://www.adenforecast.com/ or http://www.goldchartsrus.net/ |