|

|||

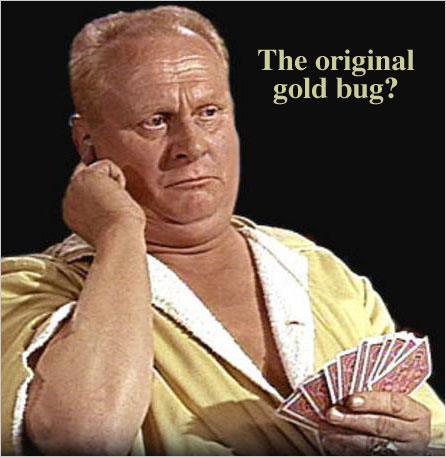

A True Believer Champions GoldRick Ackerman

I have quite a few pen-pals who are ardent goldbugs - true believers who disdain the more subtle arguments that occasionally play out in this forum. Chuck Cohen is one such fanatic, an erstwhile Rick's Picks lurker whose unqualified, well-reasoned enthusiasm for precious metals and mining shares sometimes makes me feel ashamed to have entertained even mild doubts about gold's prospects. Long-time readers will already know that I have always been bullish on gold (click here for my recent interview with Resource Investor), but also that my fervor stops short of going into hock to buy much more of the stuff than I already own.

Admittedly, the small doubts that I harbor come from my immutably hard-core deflationist perspective. While I am confident that, in a deflationary collapse, gold will do quite well versus other types of assets, I have trouble seeing anyone paying $5,000 an ounce for it in the throes of a global depression. In any event, I'll butt out for the moment so that you can revel in Chuck's unmitigated bullishness, which first aired at LeMetropolecafe.com. He believes that gold has embarked on a historical rally that eventually will eclipse the global financial system and its by-now worthless money. He writes as follows: Cutting Through the Confusion One of the marvels of the internet, is the very volume of information and opinions on every conceivable subject and at any given moment. In the realm of gold and silver, it seems almost overwhelming to try to sift through all of the data to get one's stance on the topic. We find contradictory advice telling us to buy or sell; take profits and wait for lower prices; it's going to $10,000; it's going back to $200. Many use technical indicators to support their position. There are those mysterious lines of support and resistance seemingly drawn from one arbitrary top or bottom to another arbitrary point. Many others employ relative strength, overbought and oversold indicators as helpmates. And not last of all, there are the Elliott Wave theorists with as many interpretations as there Elliott Wave theoreticians, using what is portrayed as a nearly foolproof system of analysis. I think you all know what I mean. It can be terribly confusing. All through the past 4 years or so we have many of the so-called experts telling us when to buy and sell, many changing their opinions overnight or even the same day. Sometimes, I say to myself, "didn't he just tell us to "sell" and now he says "buy." In other words, many of you are as confused currently after a 100% move in gold as you might have been back at the bottom. I don't want to sound like a shill, but that is what makes this site unique. It doesn't pretend to be a trading site, but one that keeps you informed, steadfast and focused in this turbulent and opinionated atmosphere. But in light of the massive amounts of stuff regarding gold I thought it proper to consider where I believe we are again in the gold map, especially since today we are perched at the highest level in 20 years. To make the reading easier I have placed these thoughts in an outline format. So, let's take a deep breath, try to block out all of the data and opinions of the moment and, try not to miss what I have always believed is a once-in-history economic event. GOLD IS A THERMOMETER Most importantly, gold is the ultimate barometer, or more correctly, the thermometer of the world's financial structure. During the 70's as it rose from the fixed price of $35 to a blow off of over $800 it reflected the record interest rates and commodity prices. Its move was directly related to systemic problems caused by a terrible war and unrestrained government spending. Remember "guns and butter?" Following the top, for the next 20 years, gold languished as the excesses of inflation work their way through the system. Stocks thrived and gold suffered. But all bull markets end, usually without a public announcement, just as bear markets finish and the next cycle begins. It is not like our seasons where we have predetermined dates. As the stock market was completing its manic phase and everyone in America was smitten with securities, gold unnoticed was making its bottom and a new phase had begun. In my opinion, this move, which is now about four years old, will be much more significant than the one back in the 70's because this time the entire monetary system, not just the dollar, is coming unhinged. The world's paper currency is about to unravel and gold is headed to unthinkable levels. The monetary authorities know that a rising gold price is significant and have tried to repress its rise, especially during the last 10 years or so. But the breakout in the price against all currencies tells me that they have lost the battle and gold is about to accelerate out of what has been a measured and controlled pace. Anyway, here are some of my points about gold to help you focus on the larger picture and not get thrown off course with all of the opinions that are about to mushroom. 1. PATIENCE IS REQUIRED. TRADING IN AND OUT IS HARMFUL TO MOST PEOPLE. Warren Buffett is the world's most successful investor, not because he is a great trader, but because he is patient and courageous. He is not mercurial, trying to scalp a point here or there. Instead his philosophy is to buy on weakness groups which are out of favor, and then while everyone is palpitating and excitedly buying in herd formation, he sells to them from his holdings. I think it is very instructive to follow his methods, since they have proven to be so successful over the years. Now to the precious metals. 2. WE ARE IN THE SECOND LEG OF A MASSIVE BULL MOVE. The first one took gold from its fixed level of $35 or so to over $800 in a decade. For the next 20 years, gold endured a miserable bear cycle. Then, quietly and without any headlines, the second leg began. We are now about 5 years into this leg still without much widespread acceptance, although that is changing and I believe will reach panic proportions. 3. GOLD AND SILVER RUN COUNTER TO OTHER FINANCIAL ASSETS. That means that even though the price of gold has doubled, it has done so without the help of money moving to any extent from stocks, bonds or real estate. When this begins in earnest, the price will accelerate dramatically. 4. GOLD AND SILVER ARE MOVING EXPONENTIALLY. They moved this way in the 1970's, as did stocks from 1980-2000. In fact, it appears that the nice smooth uptrend in gold has now begun to accelerate from the pattern. This is the nature of financial markets. A bull run does not conclude without everyone trying to get a piece of it. This time will not be an exception. 5. GOLD HAS MOVED THROUGH THE HIGHS OF THE 1980'S. That is a major achievement since, outside of a few fringe elements such as King Midas, there have been very few who have felt this would happen as soon as it has. Most analysts are continually adding $20 or $30 here or there to their forecast so they won't look so wrong. 6. THE MOVE HAS BEEN MADE WITHOUT ANY REAL COVERAGE OR UNDERSTANDING BY THE MAINSTREAM PRESS AND WITHOUT ANY PERIOD OF REAL SPECULATION. When Google went through $400, it made the front page of every newspaper and news source. When gold pierced $500, you had to go to the third or fourth page of the financial section to find out. The media are scratching their noggins trying to explain how gold could be rising while the dollar has been so strong. By the time they "get it" and are enthusiastically following the metals and even recommending it, the move will be on borrowed time. Look for Midas to be on CNBC or Bloomberg as a sign. Sounds impossible? The other way to measure it is to take a look at the exploration companies, many of which are down 80% from their highs of a year or two ago. If the move was at its completion these companies would look like sparklers and even your neighbors would now own some and tell you which ones to own. This phase should begin in earnest next year as gold blows away all expectations. 7. GOLD HAS EXPLODED AGAINST ALL CURRENCIES especially those that everyone had considered the strong currencies of the world. Just go to Kitco.com and review the charts of gold against the once mighty Euro and the Yen. That means that gold's rise is not a dollar-related phenomenon. The closing of the gold window by President Nixon eventually ushered in the gold movement beginning in 1971. The breakout against all of the heretofore strong currencies will have the same effect, except I anticipate something infinitely more dramatic and lasting. Ultimately, gold will be the only trustworthy currency of the world. 8. THE CENTRAL BANKS HAVE BEGUN TO NOT ONLY STOP SELLING GOLD BUT TO BEGIN TO ADD GOLD TO THEIR RESERVES. So far, we have a couple of announcement such as Russia, Argentina and South Africa, but it is reasonable to expect the others to protect what gold they pretend to have left, and even to add to it. Given the rapidly declining production and the explosive paper creation, we may wish them lots of luck. If their capping could not stop the move thus far, what will their reversal mean? 9. A WORLD DEPRESSION OR WORSE IS ON THE HORIZON. That means that the attempts to depreciate national currencies and hold up the mushrooming bankruptcies will cause a flight into the security and unchanging, unique properties of gold. Remember, contrary to what gibberish you hear and read, markets are the forward-looking mechanism in the financial world. Earnings merely tell you what happened months ago. The acceleration and explosion of gold this time around will predict the disaster that is coming. Don't expect to learn of this in advance on the TV shows or in the Times. 10. THE MYSTERIOUS WORLD OF DERIVATIVES, ELECTRONICALLY CONNECTED FINANCIAL TRANSACTIONS, NAKED SHORTS AND GOLD THAT ISN'T THERE. This is an area that is being taken on faith by the mainstreamers but has yet to be tested. If the trillions of dollars that are backed by a tiny fraction of real money are ever assaulted, as I believe they will be, we will see gold move in an entirely different fashion. I expect that very shortly the Midas $6 rule will shift to a $20 rule and eventually to much greater intraday moves where the buyers, shorters and the derivative gang vie for the barbarous metal in a frantic, and most likely, futile attempt to avoid bankruptcy and jail. The world financial structure is moth eaten, totally corrupt and will one day join Mr. Dumpty. 11. THE RYDEX PRECIOUS METALS ASSETS has actually declined during this last move. This is a barometer that I have followed and found to be highly predictive. This action is a unique occurrence which means to me that the traders or hot money are actually leaving this area rather than getting excited. This also confirms the total disinterest and lack of faith in the staying power of the gold and silver market. As Bob Hoye has repeatedly said, "Think small-techs in the early 1990's." 12. THE WORLD POLITICAL ENVIRONMENT IS INHERENTLY UNSTABLE. It is totally illogical not to expect an escalation of the terrorist activities that are demonically driven. We are powerless against a religious system that purports to reward suicidal murders with eternal salvation. I believe that the Book of Revelation points to the battles that emanate out of the nations surrounding the land of Israel. Read of the significance of the river Euphrates at the very last days. Isn't it interesting that behind the river lie both Russia and Iran. Would you trust these two nations in the long-term? 13. ENDEAVOUR MINING CAPITAL, which I consider a proxy because it is a virtual closed-end investment company, and a fascinating, unique company now selling at about a 40% discount to its net asset value. I expect that it will sell at a healthy premium at a tradable top. This discount is a further indication of the disbelief that still exists against gold. I could also add that the Prechterites are still predicting a collapse in the metals. After the move we have seen both in the metal and the shares, I still consider him to be a barometer. CONCLUSION. The nitty-gritty is that the world's landscape, in spite of the artificial prices on the stock exchanges, has dramatically changed. The past couple of years have seen gold move up evenly, with many attempts to suppress it if it started to move too quickly. I believe that the calming effect that has kept attention away from this area is vanishing and we are now accelerating in an exponential pattern. Lately, there have been some higher quality stocks such as Goldcorp, Freeport McMoran and ASA that are leading the shares higher. And as this kind of leadership has occurred, the interest in the more speculative exploration stocks has fallen away almost totally, with many of them back to the point where they were at $300 gold. Some might be concerned by this divergence, but I see it as terrifically positive and that it indicates that an explosive rise is at hand, since the rise in gold should have brought some measure of speculative fervor. I believe that the next two years will be a time in which the fundamentals of declining production and smaller companies with proven sizeable reserves will focus the share-attention upon this group. Small-Cap Explosion The rise in these smaller companies will be historic. As an example, when I first got back in the gold-share arena in late 2001, I purchased both Virginia Gold and US Gold as speculative plays recommended by my friend, Jay Taylor (whose service I highly recommend for investment ideas.) But after about a year, I lost patience due to their lethargic behavior. There were days on end when neither traded more than a handful of shares. In the past year or so, Virginia Gold has risen almost 25 times and was recently taken over by Goldcorp. US Gold has risen about 10 times in the past year and is now headed by Rob McEwen, formerly of Goldcorp. In other words, my lack of patience proved very costly. Many of the current small companies that I hold behave just as these did before their rise. Thus far, the system has held together in spite of the evidence that it is beginning to destabilize. But for those who are not content to view things through the prism and propaganda of the mainstream media, the economic problems are insurmountable and no amount of interference, propping up and manipulation is going to prevent the ultimate destruction of a system riddled with debt, deficits, uncollectible loans and a real threat of world-wide terrorism. I believe that at the end of all this is the glorious return of the Messiah, Jesus to claim his rightful kingdom and rule out of his capital in Jerusalem. But a lot of fearful events await us before then. Rick Ackerman *** You can subscribe

here. |