|

Rick's Picks Rick's Picks

Playing Gold By-the-Numbers

Rick Ackerman

Monday Jun 12, 2006

Excerpt from

Rick's Picks (website).

You can subscribe here.

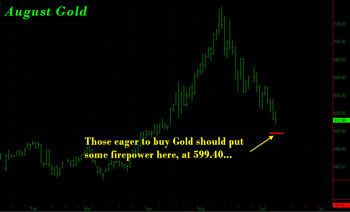

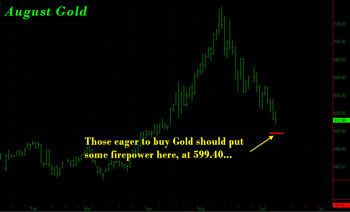

We have a bid in for August

Gold, our first attempt to buy the stuff in nearly a month as

we've waited for the correction to run its course. The bid is

based on my minimum downside target for the Comex contract, 599.40,

a hidden pivot first broached here a couple of weeks ago. A subscriber

wondered in an e-mail message to me yesterday whether he should

be picking up GLD as a proxy, since it has effectively hit the

target, registering a low of 59.71 on Friday. While the

ETF and commodity gold move closely in tandem, for purposes of

buying one or the other it is easier and less risky to calculate

separate pivots for each than to interpolate one relative to

the other.

(Click on chart to enlarge)

I've done so in Monday

morning's "Touts" for the benefit of subscribers

who want to try bottom-fishing in GLD. I am sufficiently confident

in this target that I am recommending that you buy there aggressively,

albeit with the extremely tight stop-loss I have recommended.

The trade I advised earlier in the August futures can stand as

is. We also hold positions in several gold stocks that have weathered

the metal's correction nicely. We will continue to hold those

positions until an opportunity arises to take partial profits,

further reducing our cost basis as we have been doing all along.

***

A Subscriber's Wisdom

The other day,

I heard from an investor who has $200,000 to speculate with.

He asked whether it might be a good time to make an unhedged

bet either against stocks or for gold. I suggested doing both,

via a strangle that would leave him short "the market"

and long gold and/or mining shares. My reasoning was not rocket

science. As Rick's

Picks readers will already know, I think Gold's next

leg up will take it above $1,000. As for the stock market, it

is floating on hot gas, vulnerable at any moment to a devastating

decline that will be un-defensible (and untradable) once it has

begun. Meanwhile, I must concede that I am mystified by the resilience,

so far, of consumer spending in the face of a real estate bust

growing statistically more compelling each day. As far as I'm

concerned, it is only a question of when, not whether, the consumer

economy dives, taking the stock market with it.

Regarding my advice to the $200,000 bettor, another subscriber,

Julie Hotard, has weighed in with a somewhat more measured approached

than what I'd suggested. Here it is, in her words:

"Pat P's question is an interesting one. I have been staying

away from trading recently because I have been busy selling my

house in Seattle and moving to an apartment. If I were Pat P,

I would do pretty much as you suggested. Except that I

would follow Richard Russell's rule, 'Thou shalt not blow thy

whole wad.'

Save Some Ammo

"So I would maybe put 50K to work as you suggested,

and not touch the next 50K for a month, and then wait another

month before touching the next 50K-- just in case the Powers

that Be decide that your Free Commentary is one of the most popular

ones on the web and decide to make sure your advice comes out

wrong. [I comfort myself with the notion that The Furies prefer

targets who take hubris to an unseemly pitch. Remember Joe Granville

being carried into the lecture hall in a coffin? RA]

"I'd also be long more bullion than gold stocks, just in

case the PTB decide to try anything funny with the gold stocks.

And I'd wait to invest the last of the cash, just in case gold

stocks go on sale down the road somewhere. Nothing more

frustrating than seeing your fave security go on sale when you

have no spare cash to take advantage of the fire sale prices.

The Curve Ball

"You already know, but many of your readers have not

yet learned, that it is a good thing to practice patience and

waiting, in the markets. Because just when you think you've

got it figured out perfectly, they can throw you a curve ball,

as you alluded to in your discussion of the film The Hustler.

I sometimes wonder if some of your readers think that an

expert technician like yourself can predict with 100% accuracy

every time.

"At any time, there are always new inexperienced people

entering the markets, maybe with money they inherited recently,

or made by getting a lucky break at work by closing a huge sale

or something. You are right. They should all watch

The Hustler before they commit a cent to the markets.

"Am enjoying reading your excellent commentary during my

breaks from unpacking boxes."

Thanks for your words of wisdom, Julie, and for your kind

praise.

***

Learn My Secrets

Would you like to be able to forecast trends and price reversals

as accurately and confidently as Rick's Picks? Have you

tried other trading systems, only to find them too complicated

or otherwise unhelpful? Then don't miss my Hidden Pivot Seminar

this autumn in New York City. Plans are firming for a weekend

session in early October, so please let

me know via e-mail if you think you might attend. This

will be a no-frills version of the course that I gave in Denver,

offered at a significant saving over the original price.

There will probably be just one more session offered after that

on the West Coast, but that would be the last for a long while.

The course includes post-grad mentoring via a chat group that

some of my former students have set up. If you've been impressed

with the accuracy of my forecasts, this is an opportunity you

cannot afford to pass up. Let me hear from you soon, since seat

space is limited.

***

Rick Ackerman

email: publisher1@rickackerman.com

Information

and commentary contained herein comes from sources believed to

be reliable, but this cannot be guaranteed. Past performance

should not be construed as an indicator of future results, so

let the buyer beware. Rick's Picks does not provide

investment advice to individuals, nor act as an investment advisor,

nor individually advocate the purchase or sale of any security

or investment. From time to time, its editor may hold positions

in issues referred to in this service, and he may alter or augment

them at any time. Investments recommended herein should be made

only after consulting with your investment advisor, and only

after reviewing the prospectus or financial statements of the

company. Rick's Picks reserves the right to use

e-mail endorsements and/or profit claims from its subscribers

for marketing purposes. All names will be kept anonymous and

only subscribers' initials will be used unless express written

permission has been granted to the contrary. All Contents ©2005-2006,

Rick Ackerman. All Rights Reserved. You can subscribe here.

321gold Inc

|