|

|||

Financial SupernovaRick Ackerman

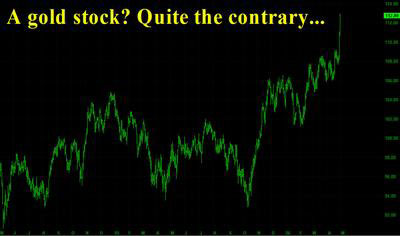

Take a look at the chart below if you want to see just how silly investors can get. I've deleted the title bar so that you can speculate on what it shows. Note in particular the bottle-rocket action of the last two price bars. Is this the chart of a company that has found a way to extract gold from seawater? To cure cancer... or baldness? To neutralize radioactive waste with a laser? (Click on image to enlarge) Nothing so exotic. Here's a hint: It's where the money is. And if you still can't guess, this is a chart of the Philadelphia Stock Exchange's Bank Sector Index (BKX) with three years of price action. Lately, shares in the two dozen bank stocks that comprise the BKX have provided one of the hottest games in town -- especially since last October, when the index began an almost vertical climb. What this reflects, more than anything else, is the attractiveness of a business where entry barriers are formidable, regulations tilted to favor the behemoths, and here's the clincher the cost of "raw materials" approaches zero. Why would anyone choose to farm, or to manufacture autos, or to smelt ore, when hundreds of billions of dollars can be made with seed money that comes almost free from the central bank? Banks Last to Fall I've always said the bank stocks would be the last to fall, but I never imagined their final fling would be so spectacular, or that it would occur even as the industries they used to serve were locked in a death rattle. Clearly, the financial shell game that has sustained America's economy continues apace, nothwithstanding $70 oil, mounting real estate foreclosures, world-ending threats from Iran, bird flu and a few other negatives that would creep out even Nostradamus. For the record, and to put some hard numbers behind the adage that whatever goes up must come down, the BKX could surge to as high as 123.09 before encountering something big and solid -- in the form of a hidden-pivot resistance. In the meantime we can only infer that investors will continue to find reasons to celebrate the banking industry's supposedly robust growth, even as the more prosaic industries that sustain America's real economy continue to shrink. Which Economy? A prominently played story in the Wall Street Journal last week marveled at the resilience of the economy in the face of $3 gas. But which economy were they talking about? Surely not America's piddling $11 trillion goods-and-services economy the one that supposedly grew at a 4.8% clip last year but about which fully 77% of those queried by a recent CBS/Wall Street Journal poll said the were seriously worried. No, the bank stocks have been energized by the other economy -- a global financial frenzy whose scope and size run into the hundreds of trillions of dollars. With petrodollars helping to fuel the mania, the financial economy starts to resemble a perpetual motion machine. We think it is something else, though: a speculative supernova with enough destructive power to set back human productivity 100 years. *** Penny Pinching Grappling with the trend? Check out Rick's Picks' archives to see how well Rick Ackerman has done with his forecasts and trading strategies. You can get a free one-day pass to visit the site, or a two-week trial subscription with no risk, by clicking here. Rick Ackerman Information and commentary contained herein comes from sources believed to be reliable, but this cannot be guaranteed. Past performance should not be construed as an indicator of future results, so let the buyer beware. Rick's Picks does not provide investment advice to individuals, nor act as an investment advisor, nor individually advocate the purchase or sale of any security or investment. From time to time, its editor may hold positions in issues referred to in this service, and he may alter or augment them at any time. Investments recommended herein should be made only after consulting with your investment advisor, and only after reviewing the prospectus or financial statements of the company. Rick's Picks reserves the right to use e-mail endorsements and/or profit claims from its subscribers for marketing purposes. All names will be kept anonymous and only subscribers' initials will be used unless express written permission has been granted to the contrary. All Contents ©2005-2006, Rick Ackerman. All Rights Reserved. You can subscribe here. |