|

|||

Are Gold & Silver Finally Airborne?Rick Ackerman

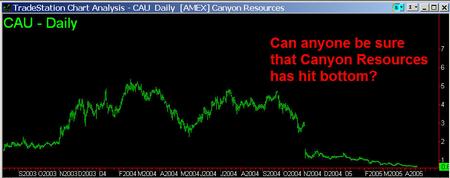

"I'm confused!" writes Bill R., a paid-up Rick's Picks subscriber. "Is this gold and silver rally going to last, or should we wait for your call for the bottom?" First of all, Bill, let me say that as investors we need never be confused about where to enter or exit a position. Both of these things are entirely knowable from the get-go, and it is well worth our diligence to fix these details in our minds before initiating a trade, since being wrong is often easier to live with than being confused. Wrong means buying a stock, having it go against us, and then bailing out. When we are confused, though, we allow psychological pain's unpredictable nuances to make such decisions for us, usually with poor results. Thus, if bullion prices continue to rise, we might jump in belatedly, angry at ourselves for having missed the bottom. We've all done this, or something like it, succeeding in the process at something we can only rarely achieve deliberately - i.e., picking the exact top. So how do we avoid being wrong? The answer is, we don't. We will always make mistakes, and so the trick is to manage them so that they don't become too costly. This implies that we can buy gold or silver assets whenever we please, so long as we have a specific goal and an exit strategy. We did exactly that the other day in Canyon Resources, a stock that has been forging relentlessly lower since early 2004. My instructions were to bid 0.64 for a thousand shares, placing a stop-loss at 0.59. As it happened, CAU bottomed at exactly 0.64 before rallying to a high of 0.69. Can we be sure we caught the low? Of course not. A look at the long-term chart will tell you why no one can know whether Canyon's long decline is over. It simply looks lower. However, by placing our bid at a hidden-pivot support, and pairing it with a tight stop-loss, we can afford to risk an educated guess. (Click on chart to enlarge) Turning to the big picture for bullion, my outlook remains bearish for the intermediate term despite yesterday's explosive rally. My gut feeling is that the dollar will remain strong for much longer than many observers seem to expect - a possibility that would have negative implications for gold and silver. If I am wrong and metals are beginning an ascent that will last for many months or possibly even years, how much will I have lost by passing up this rally cycle? I'd prefer to take its measure each day, and to act - or not act - according to the most objective benchmark at my disposal, the hidden pivot. This method might not capture every penny's worth of potential in a long bull market, but I have great confidence that it will get us long, short or flat near key turning points. And do so with sufficient consistency as to render irrelevant any concerns about missing the boat. *** Taming the Mini-Futures Trading the

S&P futures with a stop-loss of one point or less? Come visit

our archives to see how it's done. You can get a free one-day

pass to visit the site, or a two-week trial subscription with

no risk, by clicking here. |