|

|||

Is Gold's Correction Already Half Over?Rick Ackerman

We were a step behind Newmont's swan dive yesterday, bidding 1.35 for some June 50 puts that stayed well out of reach. They opened at 1.60 and traded as high as 2.15 intraday on relatively strong volume. The chart that I used to justify a change of heart concerning Newmont (and other mining stocks) is not subtle, as you can see. The divergence between rising price tops and a falling MACD shouts for attention:

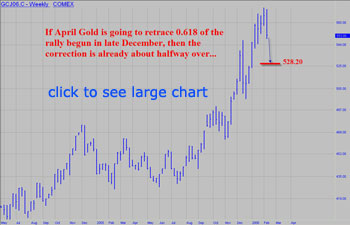

We've steered clear of mining shares for the last month or so, queasy about the toppy look of some of our favorite stocks, including Newmont, and of physical gold itself. The good news is that it probably won't be long before we can try a little bottom-fishing. Corrections in powerful bull markets are usually punitive but fleeting, and we don't expect this one to be any different. To be specific, if April Gold were to retrace 0.618 of the rally begun two days before Christmas from around 496, that would bring it down to 528.20. If so, then this correction is already nearly half over, price-wise. Here's a chart that shows it: *** No Avoiding Deflation Here's yet another persuasive essay from Prudent Squirrel Chris Laird that nicely deconstructs the inflationists' feeble fantasy that the Fed would never "allow" deflation to happen. I reprint it below with the kind permission of the author: I keep reading inflation and deflation analyses that say: "the Fed can print until there is no tomorrow, so deflation will never happen." Ok. SO the Fed prints until the dollar's value drops to zero. Who says that means there will still be demand/transacting from the consumer? If the value of a currency drops to zero, then it hyperinflates, but that does nothing for real economic demand. The US consumer is 70% of the US economy, and if he is hurt financially he cannot buy anything. Hyper inflation hurts the consumer drastically and real economic demand collapses. Basically here is the issue: When the economy is wounded badly, the ability of consumers to provide real economic demand disappears. It does not matter if the cause/effect is deflationary or hyperinflationary, in either case real economic demand collapses. The idea that hyper inflation will stimulate real economic demand enough to outrun a drop in real economic demand is a false concept. Sure, before a currency loses all its value, inflating that can create some modicum of real economic demand because people are willing to borrow against the future and buy physical and financial things.(this process is involved and has many facets). But once the rate of hyperinflation reaches a certain level, the real drop in the purchasing power of that money falls behind the acceptable transacting curve, and real purchasing power of all the currency out there drops no matter how fast the monetary authorities try to keep ahead. The currency at this point is mortally wounded. At this juncture, the economy collapses from a lack of real purchasing power and demand, and a vicious cycle of falling real wages and real demand leads to an economic collapse (demand contraction). That leads to either a hyperinflationary depression or a deflationary depression. I have written several times that the ultimate outcome of hyperinflation and deflation is the same, an economic depression. Take a look at the definition of depression: de·pres·sion Economics. A period of drastic decline in a national or international economy, characterized by decreasing business activity, falling prices, and unemployment. www.dictionary.com. Take a note of the definition. It means collapse of demand and falling prices. There are two routs to a depression, hyperinflationary or deflationary. I can provide two good examples, no three, to show this point that ultimately inflation cannot stop a deflation. Germany in the 1920s: hyperinflationary depression Real purchasing power collapses, result: hyperinflationary depression and a new currency. After WW1, Germany was forced to pay the victors gigantic financial and economic reparations. For a few years, Germany was barely able to keep ahead of this drain on their economy and currency, but, soon, they had to print more and more Marks to stay 'ahead' and destroyed the net purchasing power of their total money supply. At first, economic demand continued apace, but there reached a point where the Germans could not print enough money to keep the purchasing power of the accumulated money mass ahead of its accelerating deflation. Once that point was reached, the German Mark collapsed in a final 5 months of hyper inflation. In that period, the economy collapsed as commerce disappeared because people would not sell anything for Marks. Germans in that time would be paid at lunch each day in paper Marks and give their pay to relatives to go buy anything ASAP. Eventually that process failed, and no one would take Marks for anything. The total transacting power of all the marks printed was falling faster than the Germans could print the new money. The value of the money supply disappeared. Once the net real value of the currency falls enough, the economy stalls for lack of transactable money! (acceptable money). During this process, the total value of all the marks circulating contracted until there was not enough 'money' to run the economy. The point here is that the transacting power of the currency fell off a cliff and commerce in the economy disappeared. Result: monetary collapse, and severe economic depression. Now, when people talk about the Fed being able to avoid deflation by dropping money by helicopters, if necessary, they miss the crucial issue that, at some point, the Fed would not be able to stay ahead of the accelerating fall of the currency. Ultimately, they would not be able to maintain real total purchasing power of the currency, people would stop taking dollars, and commerce and demand would stop altogether. Inflation cannot keep real purchasing power alive, ultimately, and a collapse of demand and a depression is the ultimate end. Hence, deflation and depression. The US in the 1930s Deflationary depression After the collapse of the real estate and stock and finance bubbles of the Roaring '20s, the US entered a drastic ten year depression that began in 1929. The financial losses were so great and widespread that there was not enough money and earning power left in the economy to sustain normal commerce. The value of the dollar was all right, but people lost their money and jobs, and we got a depression. The US GDP dropped 30% in that period! Banks collapsed, credit collapsed, and businesses collapsed. That led to a vicious cycle of job losses, leading to less earning power, leading to business failures, to more job losses. It is said by some that, unless the US had entered WW2, we would have had another ten years of economic depression. (so would have the world). Here, it is not necessary to explain why a deflation occurred. Economic demand fell off a cliff and prices fell. Farmers couldn't even make enough to grow food. Ford closed their plants for 'modernization' because of a collapse in demand for cars. And so on. A classic deflationary outcome. Japan in the 1990s After the collapse of the Japanese real estate and stock bubbles, Japan entered a period of about ten years of mild deflation. People stopped all unnecessary purchases, consumer demand fell precipitously, and the Japanese government tried to stimulate their way out of it. The government lowered interest rates to literally zero. They spent a fortune with government fiscal stimulation, leaving Japan with a national debt of 160% of their GDP. The stimulation did not work, and ultimately, Japan started to pull out by reviving through exports. The jury is still out on their economy, though it has strengthened significantly in 2005. The point is that, by direct government spending and monetary flooding with ultra low interest rates, Japan did not pull out economically until normal economic forces did the lifting. Japan is still saddled with all those debts amassed fighting deflation. Here is an example that, once the consumers pulled back significantly, they were reluctant to borrow more money, which significantly negated the effects of monetary loosening. Also, the government deficit spending never did resolve the deflationary forces. Obviously, a government cannot replace a consumer in the economy. In the case of the US, if the consumer is 70% of the economy and pulls back a mere 10%, for the government to replace that spending power, it would have to deficit spend about $ 1 trillion in a single year! And that is just for that component, never mind the usual government expenses. That cannot and will not happen for long, i.e. the government trying to replace a collapsing US consumer. We would see hyperinflation with in a year probably. Then, the total aggregate value of the USD would collapse, and the US economy would stop transacting because there is not enough real acceptable currency to make things go round. Result? Hyper inflationary depression followed by massive deflation in the end and a new US currency. Conclusion Hyperinflationary solutions to deflation do not succeed in keeping the aggregate value of a currency up enough to keep demand alive. Ultimately, when hyperinflation overruns any simulative effects to the economy, the net aggregate value of all the money in circulation collapses, and commerce stops. Hence, deflation in the end. *** Taming the Mini-Futures Trading the S&P futures with a stop-loss of one point or less? Come visit our archives to see how it's done. You can get a free one-day pass to visit the site, or a two-week trial subscription with no risk, by clicking here. Rick Ackerman *** Information and commentary contained herein comes from sources believed to be reliable, but this cannot be guaranteed. Past performance should not be construed as an indicator of future results, so let the buyer beware. Rick's Picks does not provide investment advice to individuals, nor act as an investment advisor, nor individually advocate the purchase or sale of any security or investment. From time to time, its editor may hold positions in issues referred to in this service, and he may alter or augment them at any time. Investments recommended herein should be made only after consulting with your investment advisor, and only after reviewing the prospectus or financial statements of the company. Rick's Picks reserves the right to use e-mail endorsements and/or profit claims from its subscribers for marketing purposes. All names will be kept anonymous and only subscribers' initials will be used unless express written permission has been granted to the contrary. All Contents ©2006, Rick Ackerman. All Rights Reserved. You can subscribe here. |