|

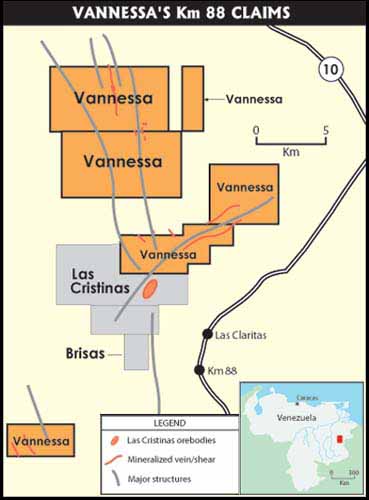

321gold.com Home | Links | Contact | Editorials | Legal Don't Cry For Me Las CristinasRobert Moriarty Pilots of fighter aircraft no longer talk about getting into a dogfight. That's a dated term. Instead they weave their hands through the air in a tight ballet and talk about the "Furball" they were in. I've heard it said that if you cut off fighter pilots' hands, they couldn't communicate at all, they need them to talk. Lately the actions taken by Corporacion Venezolana de Guayana (CVG), the local mining arm in the Las Cristinas region for the Venezuelan government, have created a giant furball between Vannessa (spelled with two Ns) Ventures (OTC BB: VNVNF.OB CDNX: VVV) and Crystallex (AMEX: KRY) with a multi-billion dollar gold mine as the prize. In 1992, a number of Canadian miners and explorationists including Erich Rauguth and Manfred Peschke, senior management for Vannessa Ventures, recognized the potential for a giant low-grade gold and copper district at KM 88 in southeastern Venezuela. The two most valuable concessions consist of the Las Cristinas mine with 11.8 million ounces of gold and over a billion pounds of copper and the Brisas property with approximately 10 million ounces of gold and another billion pounds of copper. When these properties are finally put into production, they will be world class projects.  There is a slight technical problem. While there is a lot of gold and copper ore, the grade is low, around 1 gram per ton for most of the ore. And low-grade ore requires a massive operation to produce metals profitably. Up until a few days ago, Placer Dome (NYSE: PDG) controlled a minimum 70% of the Las Cristinas claim with CVG having the right to earn up to 30%. Gold Reserve (OTC BB: GLDR.OB) of Spokane, Washington, owns the Brisas property. During the past few years, Placer Dome has sunk over $132 million dollars into the Las Cristinas property proving the resources and preparing a plan for full-scale development of the mine. Their plan called for a $500 million operation producing 530,000 ounces of gold a year with a mine life of about 14 years. But their economic assumptions called for $325 gold and $.80 copper. And neither the gold god nor the copper god has been cooperating. Gold languishes at around $267 while copper limps along at $.70 a pound. As the representative of the government of Venezuela, CVG may not own the majority of the mine but they do possess veto power over the project. Naturally it is in the best interest of Venezuela to see the mine developed. An operating mine represents hundreds of millions of dollars in revenue and the creation of hundreds or thousands of jobs. Due to the continued low price of gold, two years ago Placer Dome requested CVG give them an additional year before going into full-scale development at great expense. CVG did so. And again a year ago. All the while, the management of Placer Dome conducted a rain dance in the faint hope of higher prices for gold. While they did get substantial rain at the property, the price of gold failed to recover leaving Placer Dome caught between the proverbial rock and a hard place. A few months ago CVG issued a final warning to Placer Dome on the Las Cristinas property, "Use it or lose it." The deadline for action on the part of Placer Dome was July 15th, 2001. Placer Dome notified CVG they would not be proceeding with the development. On July 13th, Placer Dome announced they had agreed to sell their interest in the property to Vannessa Ventures much to the surprise of all. The story gets more and more interesting. Crystallex claimed for years that in fact they own the property. And sued on a number of occasions to recover what they claim is theirs. All to no avail. A last remaining appeal is pending in front of the Venezuelan Supreme Court but sources indicate the suit has little basis and probably will not go in the favor of Crystallex. None of the constant legal losses has prevented Crystallex from proclaiming victory, however inaccurately. And in fact, a few days ago they announced a master plan for development of the Las Cristinas property even though they don't control it. While Crystallex seems to be the expert in the field of public relations and propaganda, Vannessa Ventures focuses on the acquisition of additional gold and diamond properties from others unwilling to actually put them into production. Vannessa pulled off a similar coup a year ago when they snapped up the Cerro Crucitas project in Costa Rica for less than $1 an ounce for a property with 2.41 million ounces of gold. Placer Dome and Lyon Lake Mines had already spent $32 million on the property but believed they needed to spend $125 million on development to produce gold at under $210 an ounce. Vannessa sharpened up their pencils and determined they could mine a smaller amount of gold for $160 an ounce with the expenditure of only $24 million. That project is at the permit stage as you read. Vannessa already has mining claims contiguous with the Las Cristinas concession. They already have a mill in place. Of all the mining companies in the world, Vannessa has proven they can get Las Cristinas into production faster than anyone else. Vannessa is basing their plans on a projected production of 100,000 ounces a year at a cash cost of only $150 per ounce. And should the long-awaited recovery (we can dream) take place in the price of gold, full scale development will take place at Las Cristinas. Placer Dome retains the right to repurchase a portion of their minimum 70% interest but should that take place, Vannessa will retain an override interest in all production. It's a win-win situation for both Placer Dome and Vannessa. As I write, both Vannessa Ventures and Crystallex claim they will be the operator of Las Cristinas. The issue should be settled almost immediately as CVG has indicated a decision has been made. The race is not always to the swiftest, nor the battle to the brave, but that is the way to bet. My bet is that Vannessa Ventures will prevail. With 48 million shares outstanding, and a majority owned by insiders and management, if you valued Las Cristinas at what Placer Dome has already spent on the project, Vannessa would be worth over $2.75 a share for this property alone. Vannessa continues to score one victory after another and with a little more push from the PR boys, lots of investors are going to see value in the stock. Vannessa shares closed at $.47 a share on Friday the 13th. I suspect you will not have another chance to pick them up at that price. Someone may well end up with a 22 million ounce gold property at KM 88 (with a couple of billion pounds of copper). Bob Moriarty Vannessa Ventures Ltd

website Copyright ©2001 321gold Inc Home | Links | Contact | Editorials | Legal

|