|

Financial

Market Update

The Financial

Puzzle

Edward Gofsky

May 26, 2004

The last few months in the financial markets have provided an

array of cross currents to bubble up and potentially change the

course of the stock, bond, and economic landscape. I would like

to start off by talking about the stock market first and then

I will move on to talk about interest rates, the housing market,

oil, and the precious metals.

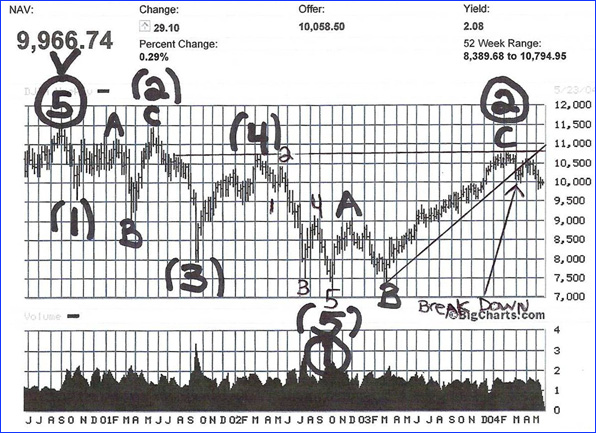

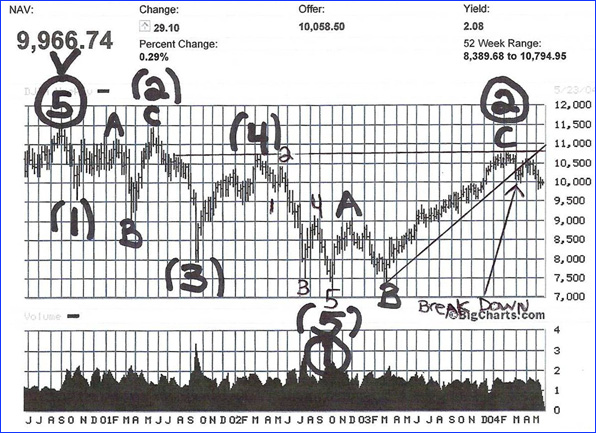

As I talked about in my last essay it looks like wave 2 of this

bear market rally had topped back in Feb/March 04. The DJIA hit

a high of 10750 and is now around the 9900 area, down over 700

points. All three indexes, the DJIA, NASDAQ and the S&P 500

have topped and are now in a 3rd wave decline going into 2005

and probably bottoming in the fall of 2006, which seems to correspond

to the 4 year cycle and the presidential cycle.

There are many

reasons to believe the bear is back, to seek vengeance on the

naïve and undereducated market participants, who have been

fooled and brainwashed by the perma bulls, CNBC and other sources

paid by wall street firms to help the firms bring in more trading

commissions by getting the public excited to buy and more specifically

to trade stocks all the time 24/7.

Obviously the first reason for a bear market resurrection is

valuation. As of may 1, 2004 the DJIA had a P.E OF 24.7 and a

dividend yield of 1.99%. The S&P 500 had a P.E of 24.9 and

a yield of 1.68%. And the NASDAQ 100 had a P.E of 38.7 and no

yield because most of the stocks in the NASDAQ 100 do not pay

any dividends. These are bubble-like valuations to say

the least, these numbers are more indicative of a top and NOT

of a bottom or the start of a new secular bull in general stocks.

Every bear market bottom of the last 100 years has ended with

a P.E under 10 and a dividend yield over 6%. We are definitely

a long way away from those types of numbers! Even if you give

the DJIA a P.E of 14, which is the historical fair value for

that index, you come up with a price level of 5796 which is well

below the Oct 2002 bottom and a very long way away from where

we are today.

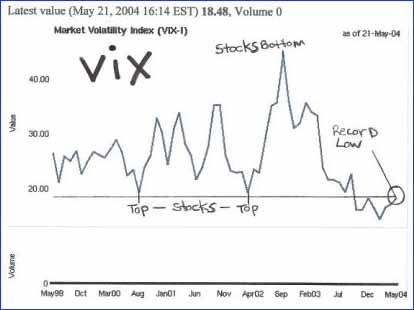

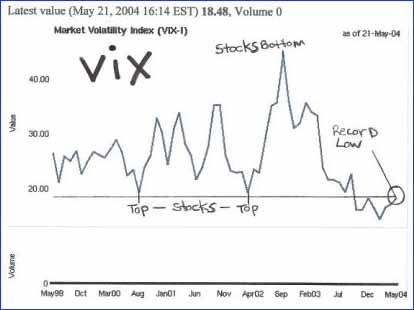

The VIX and the VXN are a measure of investor sentiment. Both

of these indicators are at multi-year lows. This shows that investors

are willing to take risks in the market and it also shows

little if any fear. Readings this low have always been the precursor

to a new bear market.

The 4 year

cycle

I love studying market cycles, they simply fascinate me! Going

back 100 years the DJIA seems to put in a bottom on average every

4 years (62, 66, 70, 74, 78, 82, 86, 90, 94, 98, 02, 06, etc)

it's never exactly 4 years to the day but if you average it all

out it comes out to 4.08 years according to the chart in my book

"The encyclopedia of Technical Market Indicators" page

182. So the Oct 2002 low was the last 4 year cycle bottom as

predicted and the next major bottom should occur in the fall

of 2006. The rallies off the 4 year cycle bottoms seem to last

about 18 months or so, so the Feb/Mar 2004 highs in the 3 major

indexes, in my opinion, were the highs in this current cycle

and we will see a decline with small bear rallies all the way

until the next 4 year cycle bottom in 2006.

The

Presidential Cycle

This cycle is very similar to the above mentioned 4 year cycle

in that each president's terms are only 4 years long. This cycle

has importance and is not very hard to understand. The theory

of this cycle is that the current president will always put forth

the most painful and economically unhealthy monetary and fiscal

policies early on in the first 2 years of his new term, and then

come right back an try to get re-elected by putting forth the

most helpful and stimulated policies in the last 2 years leading

up to the election. This was certainly true this time around

as Bush JR has pulled out all the stops both fiscally and monetarily

in the last year and a half to help him push up the economy just

in time for the Nov 2004 election.

The closer we get to the Nov elections the more tense it will

get in all markets. Especially as some political watchers are

looking for some type of Spain event occurring sometime around

election time. If you would have followed this cycle in 2000

you would have sold all of your stocks once Bush was sworn in,

and bought back in just after the Oct 2002 bottom, which seems

to correlate with the 4 year cycle above.

So as of today you would want to start selling all of your general

stocks (like DJIA ETFs) if you have not already, and wait 2 years

after the fall 2004 elections which coincidentally would give

you a fall 2006 buy signal matching the 4 year cycle above.

Rising

Interests Rates

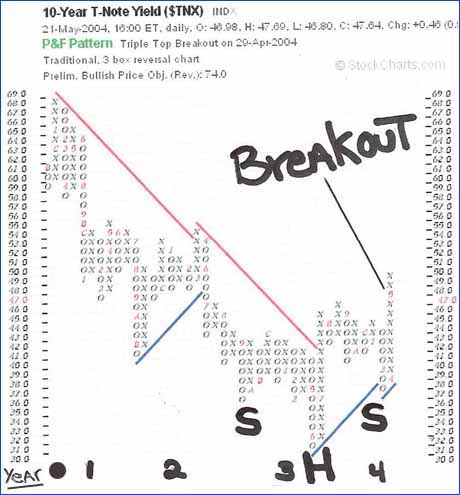

As most people in the markets watch the FED and Alan Greenspan

for magical answers to when rates will rise, I simply look at

the yield on the 10 year bond; this tells me all I need to know.

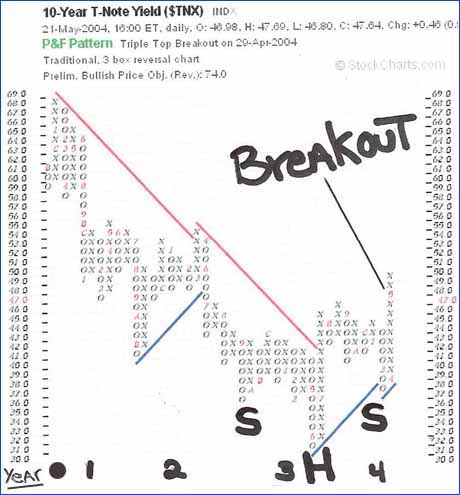

As you can see from the chart below, the yield on the 10 year

has created a text book perfect head and shoulders reversal

pattern on the P&F chart, one of the most reliable patterns

in the world of technical analysis. As you can see from the chart

the downtrend line from 2000 has been broken and the era of decades

low interest rates are over. This is not at all bullish for the

overall stock market as rising rates will hurt companies'

profits and their ability to handle their debt payments as more

money from their smaller profits has to service the rising cost

of their outstanding debt.

All an investor

needs to look at when it comes to the fed and their record in

rising rate environments is to look at what happened in the 1990's:

the peso crisis, Asia meltdown, Russian collapse, LTCM, 2000

tech implosion, Ect. With the historical amount of debt in all

aspects of the U.S economy, from the man on the street, to the

companies that sell the goods and provide the services, to the

government itself, the level of debt and of derivatives is simply

frightening.

There is no way this is going to end peacefully as simply too

much debt has been taken on by everybody, so even a small increase

in rates will bring to the forefront problems that most investors

and economists can not even imagine today. As Ike Iossif said

on a recent radio

show

with Jim Puplava and Alan M. Newman "It will only take a

rise in rates of 1% to destroy the bond carry trade."

(Borrow short Buy long) This one incident - the destruction of

the bond carry trade will be enough in my own opinion to really

destabilize the whole financial system, and believe me, the fed

knows it!

The battle over inflation or deflation is hardly over but as

of today it seems that the bond traders can see inflation coming

and don't really believe the words coming from the likes of Greenspan

and his cronies at the Fed. The bond vigilantes are demanding

higher rates to compensate for the inflation they see coming

by way of the Feds printing press and helicopter drops.

I am in the camp of investors that believes the Fed will do everything

in its power to stop deflation, even if it means printing dollar

bills and dropping them from helicopters. To the Fed and the

White House a repeat of the 1930's is simply out of the question,

it is downright unacceptable. But the policy of printing

unlimited dollars instead of raising taxes or cutting government

spending will only bring about rapid inflation, and so the Fed

in their own horror trying to stop a repeat of the 1930's may

well create a situation similar to what Germany experienced in

the 1920's "Hyperinflation". Either way, rising rates

and the current Fed policies are not good for the general stock

market going into 2005.

To quote John

Myers a contributor to the Daily Reckoning, he says so eloquently

that:

"The long

and short of it is that credit will continue to be expanded in

this country until no more borrowers can be found. Then, when

borrowing dries up, the government will become the borrower-of-last-resort,

the Fed monetizing all the government's excess borrowing or budget

deficits. This monetary inflation virtually guarantees a bull

market in gold, silver and commodities."

Keep printing,

Dr. Greenspan, keep printing!

Rising

Oil Prices

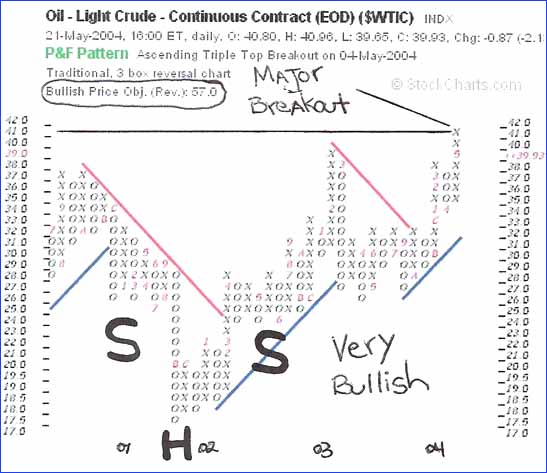

As most investors know oil just closed above $41 a barrel for

the first time since the first gulf war. This is very bad for

the stock market and the economy (except oil and gas stocks).

There are a lot of people that think this rise in oil is only

temporary and that this short term phenomenon will fall back

to the low 30's. But I would like to share with you some charts

that would tell a different story, a story of much higher prices

for oil going into 05/06.

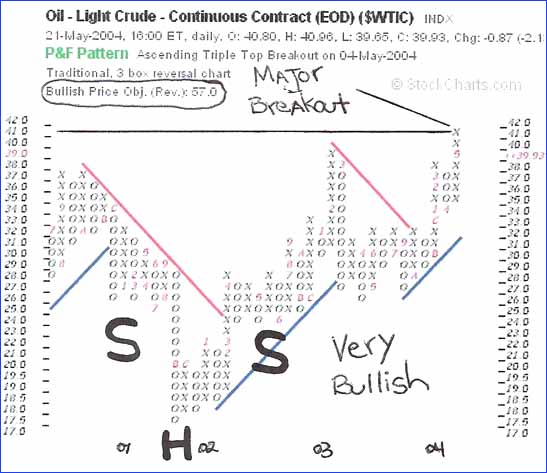

On the first chart you can see a very nice upward sloping head

and shoulders pattern that started to form in 1993. The recent

breakout over $40 was an extremely bullish event from a technical

sense. The next chart is a point and figure chart of the oil

price over the last few years; you can clearly see the breakout

on this chart. The price target on the P&F chart is $57 which

if achieved would simply rock the markets worldwide.

It will be

very important to keep an eye on the price of oil because any

shock like a terrorist attack or a massive oil spill will cause

the price to sky rocket. The situation in the Middle East is

akin to a bunch of crazy zealots running around the world's biggest

gas station tossing around lit matches. The whole situation of

rising oil and rising rates and yields brings a close parallel

to the 1970's when rising oil prices and rising bond yields (falling

bond prices) caused gold and silver to explode into record prices.

Gold

And Silver

As anyone who invests in gold and silver knows the last few months

have been tough. The bull market in both metals has definitely

taken a breather, but was the pull back a surprise? I don't think

so! And I will tell you why. First everyone knows that bull markets

ebb and flow, they go up and down, but if you follow the charts

and you can recognize the pattern it makes investing much more

fun and rewarding not to mention less stressful.

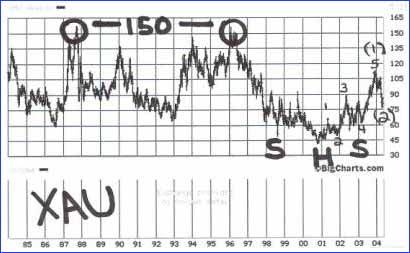

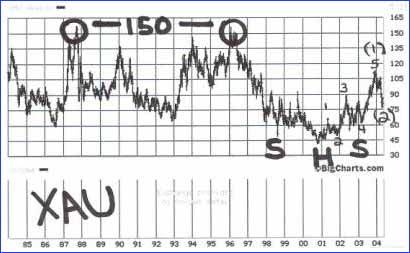

The recent top in the HUI and the XAU gold indexes were nothing

more than the wave (1) top of a (5) wave pattern. (For a full

detailed analysis of the Elliott Wave Theory please read the

classic and most recognized book on EWT "The Elliot Wave

Principal" by Frost and Prechter. As you can see from

the chart below there is a clear 5 wave pattern in both the XAU

and the HUI. As anyone who is familiar with EWT knows, the wave

patterns are fractal in nature, meaning that one set of Elliott

waves are just a pattern in a much larger wave at a higher degree

of trend.

So as I have been seeing panic selling in the last few weeks/months,

I just sit back and smile as I wait for the wave (2) bottom and

the glorious wave (3) rally to new highs going into 2005 and

2006. (A break of 113 on the XAU and a break of 256 on the HUI

would signal the start of wave (3).

I believe the final 5th wave in gold and gold shares (which will

be the frothy mania) won't occur until later this decade, when

gold hits $1000 and silver is over $50. I don't trade in and

out everyday and let my precious capital get killed by commissions

and slippage, I just look for clear long term wave or classical

technical patterns to develop and then invest in those sectors

with those patterns and sit tight and wait for the patterns to

complete themselves.

As you can see from the long term chart of the XAU, this massive

ultra bullish head and shoulders reversal pattern has the 150

level written all over it! I will personally just wait and let

this pattern complete it's self and then SELL and take my profits

(which is the most important aspect of investing), please read

the two books "It's when you sell that counts" and

"when to sell" to get a good handle on when

to sell, and why it is the most important skill to acquire in

investing and trading.

So for all

you fellow gold and silver investors out there that are getting

stressed out I say to you, calm down, relax and just let the

patterns do what they will do, and in the case of the XAU what

they will do is go to the 150 level in 2005 or 2006.

Before I finish up this part on gold and silver I want to clear

something up for the new gold and silver investors out there.

Please don't be fooled and believe the lies spewed out of CNBC

and the people trying to get you to sell your gold and silver

and gold and silver stocks to them at a wave (2) bottom so they

themselves can take them from you, leaving you naked,

so they themselves can enjoy the bounty of a magical wave (3)

rally.

Don't listen to people who say that rising rates will hurt gold

and silver, because all you have to do is look at this chart

below of the yield on the 10 year bond going back to 1960. This

chart tells you all you need to know, when yields rose throughout

the 1970's so did gold and silver and when yields fell for 20

years from around 1982 to present gold and silver have been down.

It has only been since 2001 that gold and silver have really

rallied probably anticipating higher rates into the future, and

here we are in that future and all you hear about is higher bond

yields and higher fed funds rates.

So please look at this chart and notice that when the yield on

the 10 year bond was over 10% in 1980 where was the price of

gold and silver? $850 gold and $50 silver, and what is the yield

on the 10 year bond toady? it is only 4.76%. So in my own analysis,

rising rates and bond yields are very bullish for gold and silver,

so the coming rate increases by the fed to fight inflation and

the bond vigilantes is only the beginning of the bull market

in the precious metals.

Stalking

the Housing Bubble

I am a ferocious reader of books, newspapers, and many financial

newsletters. In the past few months while I have been reading

my financial newspapers I have been cutting out and keeping all

the articles about the big housing boom. I have studied and read

about most of the financial manias of the past 500 years from

the john law scandal of 1720 to the crash of 1929 to the bubble

of the late 1960's to the gold and silver bubble of the 1970's

and most recently, the tech bubble of the late 1990's.

Most manias (and it does not matter which time frame you are

using, because all manias have the same underlying characteristics)

that are talked about in the financial media have a few choice

words that are used over and over again to describe what is going

on in the market that has all the attention of the mass public,

be it gold, tech stocks, nifty fifty stocks, real estate, baseball

cards, fine art, or radio stocks. Below I will list some of the

most recent headlines from my local newspapers around my home

town of Vancouver Canada (The most expensive place to live in

all of Canada!).

In all the manias I have studied, the words most used in the

press are MANIA, BOOM, HOT, FEVER, RECORD, HIGH, and SKYROCKET.

In the biggest manias some of the words are put together!

Here are some of the headlines from my local papers, you be the

judge and ask yourself, is this a real mania? because it sure

looks and sounds like one to me, this will only end badly in

the coming years as rates on mortgages rise:

CONDO-MANIA

Vancouver Province, Sunday, Feb 29, 2004. Front page story!

CONDO FEVER GETS EVEN HOTTER

The Vancouver Sun, Wednesday, May 5, 2004

URBAN CONDO BOOM

HITS RICHMOND

The Richmond Review, Weekend edition, May 15-16, 2004

VANCOUVER'S CONDO MARKET KEEPS GETTING HOTTER

The Vancouver Sun, Saturday, April 3, 2004

MARCH CONDO SALES BIGGEST ON RECORD

The Vancouver Sun, Saturday, April 3, 2004

CONDO SALES SKYROCKET

Vancouver Province, Monday, April 5, 2004

I will close

this part of my essay with a small article that just recently

came out and was totally under the radar screen of most homeowners

and investors. If you have decided that this is a full blown

mania and that home prices will fall over the coming decade,

what will the implications of this article mean for most investors

and the economy when rates rise much higher over the next decade?

I will leave it up to you!

HOMEOWNERS

DREW $29 BILLION IN HOME EQUITY

Canadian homeowners refinancing their mortgages, mostly as home

equity loans and lines of credit, are creating an annual impact

equal to the creation of one million new jobs, according to a

study by CIBC world markets.

Canadians took $29 billion from home equity from 2002 to 2003,

the report states.

"Canadians have been refinancing their mortgages at a pace

never seen before," said Benjamin Tal, senior economist,

CIBC world markets. The CIBC says refinancing put $36 billion

of extra purchasing power in the hands of mortgage holders. "This

is equivalent to the annual income from one million new jobs

being created."

When mortgage holders refinance, about one in three increases

their mortgage amount by $28,000, leading to an $18 billion increase

in total mortgages outstanding in the economy, according to Tal.

Given current mortgage rates, the report estimates that almost

a quarter of mortgage holders can still benefit from refinancing

their mortgage, adding to the 50 per cent whom already have.

Homeowners draw equity from their homes for home renovations,

other real estate investments, education and a myriad of other

reasons.

Final Comments

In closing this essay I would like to summarize that when you

put all of these pieces of the financial puzzle together, it

is very bearish for the general stock market, bearish for bonds,

bearish for real estate, bullish for precious metals and bullish

for oil.

There is simply too much risk in this market for anyone to be

fully invested. I would highly recommend that investors of all

ages start to raise their cash positions and start to buy some

deeply oversold gold and silver stocks before the wave

(3) rally going into 05/06 in the HUI and the XAU.

Get ready for a very violent return of the bear in the DJIA,

NASDAQ, and S&P 500, I am sure the bear did not appreciate

getting tied up and tossed off the boat by the bull a few weeks

ago! (Reference to the front cover of Barron's soon to be remembered

as one of the most historical sell signals of all time!) So I

can imagine that he is a little ticked off, the bear will come

back and slaughter all those who disrespected and mocked him

over the next 2 years into 2006 in an "all-you-can-eat

perma-bull massacre."

The last thing that I want to share with all of you is this very

important message.

I love studying Elliott wave patterns, classical technical patterns,

cycles, gold and silver, call and put options and many other

sophisticated ways of investing or trying to predict the future

trends of price action in the markets.

But I strongly encourage all of you not to forget the most basic

laws of financial planning. I encourage all of you to always

have a solid financial plan and to always follow some basic but

very important rules about how to get rich slowly.

Everyone today wants to get rich quickly, like buying a tech

stock at $1 and riding it to glorious profits and selling out

at $50. That's great and all, but these types of investments

should only be implemented after a solid financial base has been

built.

I have been studying financial planning since I was 17 and I

really like to consider that my specialty. So before I go today

I want to share some very basic strategies for building a solid

financial base for a secure future.

• Self Education: Anyone

who wants to do well in the financial markets needs to do a lot

of reading. Every investor needs to make it a priority to teach

themselves the fine art of financial planning and proper money

management. I advise people to not watch CNBC because they are

paid by Wall Street to only talk about buying stocks and how

great the economy is, you get a biased opinion in other words...

Every investor needs to think independently.

• Owning your own home:

Paying

off your mortgage every month is a great way for saving and asset

building.

• Start saving and investing as early as possible, so you

build the habit and take advantage of the compounding of your

money.

• If your goal is to become wealthy, you must make some

important choices such as, deferral and doing without, and putting

money away with considerable frequency.

• You must put at least a small portion of your

savings into investments that can not be printed up by the printing

press. Buy physical gold and silver coins and bars.

• Stay out of debt: Only own 1 credit card.

• Live well below your annual income.

• Create multiple streams of income (earned income, passive

income, portfolio income).

• You must live by the commandment of living modestly and

saving regularly.

• You must be a saver and not a spender.

• Keep consumption to a minimum.

• Read all the books by author Napoleon Hill, he has written

some of the best books ever on how to use your brain to attract

things and people towards you, mainly money and financial well

being. I highly recommend his first book "Think and grow

rich" it just might change your life!

Every investor needs to tailor a financial plan for their own

individual circumstances, but anyone can follow a few of the

above strategies.

Building a solid financial foundation is the best thing any investors

can do for themselves.

I love getting

feedback from all my readers around the world, so please drop

me a line if you have any questions or comments.

Edward Gofsky

May 26, 2004

Email: Eddy_gofsky@yahoo.com

Edward Gofsky

lives in Vancouver B.C, Canada where he studies Elliott Wave

Theory and Classical Technical Analysis.

Copyright ©2004

Edward Gofsky. All Rights Reserved.

______________

321gold Inc

|