321gold.com

Northland Resources Inc.Commentary by the Jordanfund With the oil, gold and uranium prices soaring, Iron Ore is one material which hasn't received much attention from investors. But the fact is that at current prices, iron ore is more profitable than gold to mine. The company which we are looking at in this article, Northland Resources, is primarily an iron ore company in transition from pure explorer to explorer and producer, with:

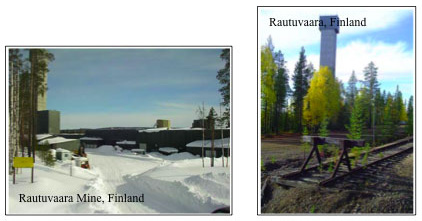

Northland's exploration programs have been fast and cost effective, primarily because of the availability of millions of dollars' worth of high quality exploration data -such as drill core samples- compiled and archived by the Swedish (SGU) and Finnish (GTK) Geological Surveys.  The pictures show an existing past producing mine which lies within Northland's land holdings. They illustrate very well that the infrastructure for the starting and maintaining production is for the most part in place, and one of the largest mining companies in the world is operating in the same region and may be willing to make an offer when Northland has completed its feasibility studies. The company already has technical cooperation agreements in place with the giant mining company, Anglo-American plc ("Anglo"), and has become Anglo's "sniffer dog" when looking for metals. The key to success in this case is an experienced management with a successful track record and with the capability to find financing when money is needed. Northland Resources registered in Canada is a well organized and debt free exploration company operating in Sweden and Finland. They currently have 29.2 million shares issued which corresponds to a market cap of C$25.4-million at the time of writing (41 million shares after full dilution). Chief Executive Officer Buck Morrow has over 30 years' of experience of mineral exploration, mine development and operational management of mines. Some of the largest mining projects in Nevada were developed under his leadership, including the Barrick Goldstrike mine. Northland's objective is to become a producer of gold, iron and copper. The Company is in possession of a total of 100,000 ha in one of the most promising iron-oxide-copper-gold (IOCG) belts in Europe. The high quality gold deposit at Barsele North gives the company an added "sting" in its tail. As late as December 2005, Northland acquired 7 copper licenses from Anglo. The rumours are that the technical merits of these properties are so good that NAU could not refuse the opportunity that Anglo presented. A stock exchange listing will likely be done in London or Stockholm before the summer and JF is in this case working towards listing in Stockholm. Northland's projects include: Barsele North Gold Project, Sweden (60%) they are working on an update of the NI43- 101 resource estimate. The existing assets of 639,000 ounces of gold are expected to increase to approximately 1 million ounces. We expect the report will probably released within approximately a month. At the time of writing, Northland owns 60% and was working hard to acquire the remaining 40%. Since we wrote this piece, they have succesfully acquired the remaining 40% from MinMet plc in an "all shares" transaction. Stora Sahavaara Iron Project, Sweden (100%) a non-43-101 compliant resource of 190 million tonnes of iron ore with an average content of 45.2% iron + 0.07% copper is quoted by the SGU. The deposit is open downdip. NAU is planning to start mining operations here during 2007-2008 and owns 100% of the project. An NI43-101 resource estimate should be released in March/April when approximately 100-million tonnes of iron ore will likely become assets. Kolari, Finland (100%) This covers the Hannukainen mine which historically has produced 4.56 million tonne of ore (43% Fe, 0.88% Cu and 1 g/t Au) and Rautuvaara which historically has produced 11.6 million tonne of ore (42% Fe). Kolari is estimated to contain a total of 200 million tonnes of iron ore (not NI43-101 compliant). NAU is looking at the feasibility of profitability mining the iron alone which means the presence of copper and gold credits is an added bonus. It's wise not to underestimate how valuable this bonus is, considering the historical yield: a conservative estimate -based on 0.5% copper and 0.5 g/tonne gold- is that the 66 million tonne Hannukainen ore body alone would correspond to 2 million ounces of gold equivalent (Cu) + 1 million ounces of gold (Au). This would correspond to 3 million ounces of gold at essentially no production cost. Saarijarvi No 2 License In early 2006, NAU will try to identify its "top priority targets" out of the recently acquired licenses from Anglo. First on the list ought to be Saarijarvi No 2 where the highest grades have been reported at 7.6% copper and 14.3 g/t gold. In total, we believe Northland will be able to put together a portfolio of deposits containing approximately 400 million tonne iron ore (44% Fe) when their resource work is completed. Using conservative long-term price estimates of US$50/tonne for iron ore and a conservative estimated resource of approximately 100 million tonnes of iron ore, we calculate an historical in-situ value of US$5 billion calculated for the company. This translates to a gold equivalent resource of 10 million ounces of gold. During 2007-2008 the company will go in to production or will be able to sell at high value to one of the large players operating in the area. It's important to stress that to date, these assets are not NI43-101 compliant with the exception of the Barsele gold resource, but if we assign a value of 2% of the total sales value we arrive at a net present value of US$ 100 million for the company. -Jordanfund Northland Resources website: www.northlandresourcesinc.com More information:

|