| |||

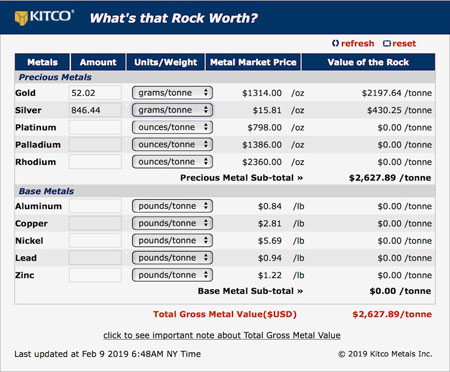

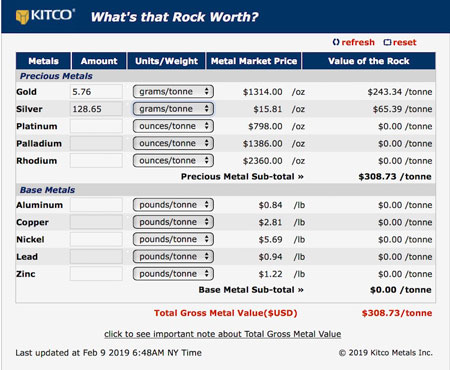

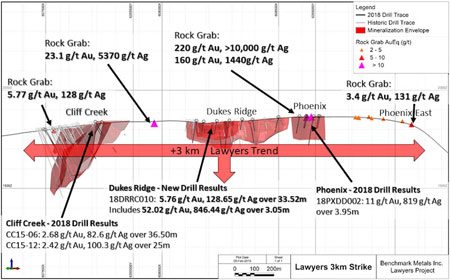

Benchmark Delivers 52 grams Gold Over 3 MetersBob Moriarty I talked about Benchmark back in October of 2018. Even though gold and silver have done well since then, the juniors still suck. BNCH was $.25 then and $.185 now. I don’t expect that to continue for long if they keep delivering outstanding drill results as they just have from the Lawyers project in the heart of British Columbia. For some reason investors tend to think only in the short-term. The long-term bottom for gold showed up in August of 1999 at $252 but the resource shares continued down well into 2001 before they caught a bid. I am convinced that the latest major bottom for gold was in early 2016 however many juniors are still just puttering along. One day soon investors will understand that 52-g/t gold over three meters is a great hole. (Click on images to enlarge) 52 g/t Au over three meters is almost $2200 USD a ton rock just for the gold but don’t forget, this is a gold/silver system and the 846 g/t Ag adds another $430 USD a ton in silver credits for a total of $2627 a ton USD rock. The silver alone would be a home run hole. And if you extend to the limit of the mineralization, you have a 33.52-meter wide intercept with $309 USD rock. A few more of those and you have a rich mine. While throwing money at the entire junior market has not made financial sense since the big run up ending in July of 2017, individual stocks have done very well when they showed they had the goods. I talked to Great Bear early in 2018 and they told me what they had planned. The shares were about $.50 and they had a tiny $12 million market cap. I told them that if they delivered they would have a $5 stock. If they communicated effectively to the market the $5 would come early. But eventually even if they did a rotten job of communication, the market would get it. They took the route of rotten communication and the shares are now $3.68 and will someday get to $5. Now they have a $133 million market cap and investors who could figure out what they had raked in a 600% return. You need one of those every five years or so to retire. Benchmark has a deal on the Lawyers project in the central British Columbia that calls for them to spend $5 million in exploration to get 51% of the property and an additional $4 million and 2 million shares to get up to 75%. Lawyers had an existing gold mine that produced 65,000 ounces of gold and 900,000 ounces of silver yearly from 1989 until 1992. In June of 2018 BNCH released a current 43-101. Depending on the cutoff grade, the resource was up to 170,000 ounces of gold and 6.7 million ounces of silver. In a masterpiece of really excellent communication, the company posted a plan view of the 3.1 km Lawyers trend in their last press release. That image tells the whole story of why Benchmark has bellied up to the table and forked over up to $9 million to roll the dice. They have wildly economic gold and silver values across an entire 3.1 km length. They are going to need to spend a lot of money just doing infill drilling so it really doesn’t matter what they have committed to, they have to spend the money anyway. But when a hole shows 33.52 meters of mineralization from surface of $300 rock, you have a home run in the making. If you communicate. And they have done a brilliant job. Naturally the company will have to continue to raise money so there will be dilution over time. But so far the company has done a great job of the technical work required to create a viable mine and nice drill results. Do remember that these are short; mostly under 100 meter holes so they don’t cost much. When the company first contacted me and told me the story, I went out in the open market and bought shares and then waited patiently for results. They have started to come in now and will continue for a long time. Unlike Great Bear, Benchmark does a wonderful job of communication and explains why they are so excited by the project. I don’t know if the stock will get to $5 any time soon but I can tell you it’s not going to sit at $.185 for long. If you don’t want to buy in there, I will. Today they have an $8 million market cap. The 43-101 would support a lot higher price than that for what they have already proven. The market will get it soon. Benchmark is an advertiser and I do own shares. Naturally that makes me biased. Do your own due diligence. Benchmark Metals Inc ### Bob Moriarty |

Copyright ©2001-2024 321gold Ltd. All Rights Reserved