| |||

"I Surrender"Kevin Dougan

I have been a dyed in the wool Gold Bug for the last quarter century. While I have made tremendous $$$ when Gold shines, the last 7 years have been absolute torture. It seems like every month my hopes are dashed but the final nail in the coffin was when the month of September (usually a great month) came and Gold got hammered again, I finally realized that I’m done, for now. I surrender, I give up!!! I need a place to park my money where it will appreciate till things change and Gold becomes King again. For now, I intend to become the “Prognosticator of Petroleum” 😊 My goal with Mick’s Picks is to find undervalued, unknown, unloved Junior Resource companies and to capitalize on their explosive growth when the masses pour in. Problem in this day and age almost every mining company is at its 52-week low and there is nothing but value out there. Compounding the problem is they won’t turn till the price of Gold finally turns. I am sick and tired of so-called experts touting its return to glory, as I have been hearing for countless years. Therefore, I’m turning my focus to Oil & Gas Explorers for help in rebuilding my beleaguered portfolio. Instead of North to the mountains, I’m looking east to the prairies. Oh, give me a home where the buffalo roam 😊

The great news is even though the Oil Market is relatively new to me, the same fundamentals hold true to find winners. Management as always is key, as well as location of where the properties lie, ability to raise cash and share structure. Of course, as always, pain staking due diligence along with interviewing and getting to know CEO’s & Directors …reading other analysts’ opinion, scouring the internet to gain knowledge on the sector and viewing and reviewing all educational videos out there so I can at least be able to ask intelligent, provocative questions. First, I must confess till now all I really learned about Oil was under the tutelage of one, Jed Clampett. I remember I was 5 years old watching a black and white TV set that looked much like a washing machine. It was here I discovered “The Beverly Hillbillies”. It was a rags to riches story of a poor Ozark family that struck it rich while hunting possum for Granny’s famous stew… misfiring and hitting an oil well…striking it rich in the process.

Come and listen to my story about a man named Jed

As I child I learned Oil was Black Gold …now why did it take me almost 50 years to figure that out. I think I was too transfixed on Ellie Mae but alas, I regress. 😊 I am now on a mission to find the best Oil & Gas plays out there for my readers and make up for lost time. These Oil plays thankfully are explosive as Gold plays however they are just as elusive to find. Oil is now on a steady upswing. In early 2016, oil was $26 a barrel and is now hovering $70+. I like parking my money in something that recently had a triple valuation and soon profits will start hitting the bottom line hopefully catapult the share price of worthy companies. To find the companies with the most upside I go to www.321gold.com and see if I can glean something from that website. If Bob Moriarty likes something, that gets my immediate attention. It was there I found he likes a company named Jericho Oil. It was now my job to vet the company and see if it meets my own sniff test. That entails countless hours combing the internet preparing me for a call to management. I need to have a semblance of knowledge of oil and gas to ask tough, intelligent questions and glean and report back to my readers and website followers what I have learned.

Jericho Oil (JCO) is an oil & gas exploration company that holds key land positions in crude rich Oklahoma. They acquired these key assets at major discount when oil was out of favor and hovering in the $30 a barrel range. At that time absurdly, a barrel of oil was cheaper than a bucket of Kentucky Fried Chicken… my how the worm has turned. Oil is the asset appreciating in price faster than any other resource. It is hovering around $72 a barrel and forecasted to possibly approach $100 in the near future. It sure makes the management of JCO seem prudent for scooping up assets when they were totally out of favor. Buying low and selling high seems like a no brainer but human nature precludes most from taking action. Jericho Oil is a horse of a different color. Inherently the oil business is risky but one must branch off from the herd and make a bold stand. JCO did and stands to now profit handsomely from those bold, prudent actions. The great news is shareholders and more importantly new shareholders stand to gain the most in the months to come. While the oil price has sky-rocketed, the shares have not yet caught up to ride the coattails of crude. The newly generated profits from rising oil prices will soon hit the bottom line… surely to catapult share prices of Jericho higher. As I discussed experienced proven management is key to any company when one considers investing. The CEO of Jericho Oil is Brian Williamson. He has been an active participant in the oil sector since 1995. He cut his teeth working for renowned accounting firm Arthur Anderson and also spent many years in the capital markets. He handles the day to day affairs of managing and directing Jericho towards future growth always on the lookout for new properties for the stable. Allen Wilson is President and director of JCO. He brings capital and corporate development strength as well as experience in the energy sector working as a director with New Castle Energy, till recently handing over the reins to focus solely on JCO. Auspiciously, he is President of the prestigious Marine Drive Golf Club in Vancouver BC. I’m sure that never hurts when trying to woo prospective high net worth investors… being able to secure a prized tee time.😊 The all-important Investor Relations department is run by 20-year veteran, Adam Rabiner whose many long-term ties make a noteworthy asset. In this day and age having a dedicated IR person is a luxury and certainly not the norm, at least for cash strapped gold and silver miners. Marketing and Promotion never costs but seemingly always pays off in spades.

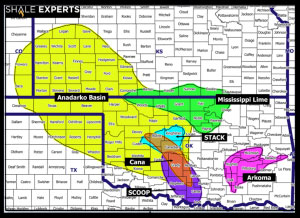

I also discussed the importance of the properties in the JCO stable. A core part of their holdings is in the Anadarko Super Basin which has produced over 5 million barrels of oil. They are part of the STACK group (Sooner Trend Andarko Canadian Kingfisher) which they smartly gobbled up on the cheap for an average cost of ≈$2,300 an acre during the lean years. Currently similar STACK acreage is selling upwards of $8 K -$10 K an acre. Buy right, sit tight … a quote from perhaps the greatest stock trader of all time, Jesse Livermore has always been paramount to any successful investment. When I hear STACK, Dolly Parton comes to mind but I will have to visit the real Stack hopefully sooner than later to get that image out of my mind. (Click on image to enlarge) Jericho is very tightly held, there are 128 Million shares outstanding and ≈100 million of those are held in certificate. Approximately 46.5% of JCO are held by insiders in for the long-term. They were the early money and have much belief in the team and its projects. The remaining 28 Million shares are freely traded which provides plenty of liquidity for the average retail investor. There is a nice cushion of $4 Million in the treasury and finding new money has never been a problem and was raised without the help of banks. The same loyal shareholders of note have always readily contributed when the need arises for additional cash. There will be a point in the not so distance future when with the sky rocketing price of oil, the assets that were purchased at 80-90% discount will start finally start becoming steady revenue streams. The balance sheet should reflect a very healthy and wealthy consistent improvement each month.

This article was an attempt to introduce you to a company, Jericho Oil (JCO) in a very healthy growing sector. Oil is an asset that is always and forever will be in great demand. New technology and modern exploration techniques are allowing more oil to be produced and old wells to be revisited with the new more attractive price for oil. This is just a cursory overview of a company I find very attractive and worthy of much more due diligence. The fact JCO is off close to 60% off its yearly high screams opportunity for appreciation and is a favorable entry point. In the coming months, I will conduct an in-depth interview with the CEO, Brian Williamson. Also, a sight visit is in the works so I can see first hand what this company has in it growing stable. I plan on becoming as well versed in oil companies as I am in Jr. Gold Miners. I want my money in a sector that is poised for growth and the rising price of crude oil dictates that.

While this surrender out of Gold and into Oil pales in comparison to Napoleon’s famous admission at Waterloo, it is a very big leap for me and will require me to learn a new resource sector from scratch… but as stated earlier… Oil can produce as much if not more wealth than Gold. The key as always is finding the right companies with solid management, assets in a safe jurisdiction and a well thought out plan for growth and profitability. I will close with who brought me to this dance, Jed Clampett, some 50 years ago when he came up with that bubbling crude. Jed was so wealthy he had bankers chasing and bidding for his new-found wealth. He smartly settled for one famously named, Milton Drysdale. My hope is for myself and my readers to need a personal banker if we too strike it rich in the oil business. Jericho seems a great company to start with and subsequent articles hope to prove this out.

Jericho Oil ### Kevin Dougan This report is for information purposes only and my opinion to point you to a company that I feel has promise and in a growing market sector. I am not an investment advisor. Seek your own finance professional when making any investment decisions. I own a marketing company that specializes in small cap resource companies. Jericho Oil helps support my website with a banner ad. Blue Sky Marketing is a contract marketing firm connecting under valued Jr. Miners with interested investors. It is run by Kevin Dougan, a former IR person and 15 year successful investor and follower of the Jr. Mining Sector. |